Capital Reallocation in response to Debt

The “Debasement Trade” is a prominent investment strategy in current finance, defined by the systematic movement of capital out of assets denominated by sovereign promises, such as fiat currencies and traditional fixed-income securities, and into assets characterized by verifiable, finite supply, often referred to as “hard assets” [1]. This strategy is fundamentally a defensive measure, designed to preserve the real value of wealth against the risk of the currency’s diminishing purchasing power, which results from accelerating national debt and large/rapid monetary expansion [2]. The shift reflects a growing, fundamental loss of confidence in the long-term fiscal solvency of major economies, especially the United States, whose currency serves as the global reserve.

I. Historical Context: Debasement as a Sovereign Tool

The act of currency debasement, the reduction of a currency’s intrinsic value without altering its face value, has been a recurring fiscal strategy throughout history. While the methods have evolved, the economic rationale remains consistent: to increase the effective money supply to meet government financial needs, typically to fund large expenditures or manage mounting debts [3].

Physical Debasement: The Precedent

In the ancient and medieval worlds, debasement was a physical process. The Roman Empire offers a classic example, where successive emperors reduced the silver content of the denarius over several centuries [4]. By substituting precious metals with cheaper base alloys, the government could mint a greater volume of currency from the same reserves, allowing the Treasury to stretch its resources for state expenses. This practice, however, led directly to rising prices (inflation) as merchants recognized the coin’s diminished intrinsic worth.

Another significant example occurred in 16th-century England under King Henry VIII, a period often cited as the “Great Debasement” [5]. To finance ongoing conflicts, the silver purity of English coinage was drastically reduced (From over 90% to as low as 25%). This act, while providing short-term funding for the Crown, destabilized domestic and international trade, leading to public mistrust and prompting the widespread hoarding of older, purer coins—an economic phenomenon later formalized as Gresham’s Law (“bad money drives out good”) [5].

The Structural Shift to Fiat Debasement

The transition to a fiat monetary system fundamentally redefined debasement. Following President Nixon’s 1971 decision to suspend the convertibility of the U.S. dollar into gold, the global financial system moved entirely away from the commodity-backed anchors of the Bretton Woods agreement [6] (See our Article on Bretton Woods). In this modern context, debasement is not about physical manipulation but about administrative action: the unconstrained expansion of the money supply through central bank policy. The erosion of a currency’s value is now primarily a function of excessive issuance relative to underlying economic productivity [7].

US M2 Money Supply

Figure 1 Source: Federal Reserve

II. The Conditions of the Modern Debasement Trade

The current period is characterized by macroeconomic conditions that have accelerated investor concern and institutionalized the Debasement Trade as a key portfolio consideration.

The Scale of Sovereign Indebtedness

The primary catalyst is the unprecedented scale of the U.S. National Debt, which is over $37 trillion [8]. Unlike previous debt cycles, the current trajectory is sustained by structural spending (23 consecutive years with deficit, last 5 $trillion+), regardless of the political party in power [9]. This fiscal reality presents governments with a limited set of options: implement politically unpalatable spending cuts or tax hikes, or employ the politically more palatable solution of allowing the currency’s value to decline.

The Debasement Trade is predicated on the rational assumption that policymakers will inevitably choose the latter, utilizing monetary tools to reduce the real burden of the debt and its service costs [1]. Through inflation, the real value of the debt owed to bondholders is effectively diminished over time, a process often described as “financial repression.”

Investor Flight to Scarcity

The response from institutional investors has been explicit. Citadel CEO Ken Griffin has been a vocal proponent of this thesis, characterizing the current market environment as a “debasement trade” [10]. Griffin notes a tangible shift in capital, with investors seeking to “de-dollarize” and “de-risk their portfolios vis-a-vis US sovereign risk” by accumulating non-fiat assets [10].

This trend is observable through market data:

- Currency Depreciation: The U.S. dollar index (DXY) has experienced significant periods of sharp depreciation against major currencies and, more dramatically, against hard assets like gold [11].

- Reserve Diversification: Globally, the dollar’s share as the primary reserve currency held by central banks has been steadily declining, reaching multi-decade lows [12]. This signals a structural move by foreign governments to reduce reliance on the U.S. dollar, further supporting the debasement thesis [13].

US Dollar Valuation

Figure 2 Source: Federal Reserve

III. Monetary Policy, QE, and Hyper-Liquidity

The mechanics of modern debasement are inextricably linked to central bank interventions, specifically Quantitative Easing (QE).

Quantitative Easing and Money Supply Growth

QE, a policy initiated following the 2008 Financial Crisis and dramatically expanded during the 2020 COVID pandemic response, involves the central bank (the Federal Reserve) creating new electronic money to purchase vast amounts of government and mortgage bonds [14]. This injects large amounts of money (hyper-liquidity) into the financial system, resulting in an exponential, historically unprecedented surge in the M2 money supply (See Figure 1) [14].

This expansion is the engine of modern debasement. When the volume of money in circulation grows at a pace far exceeding the underlying growth in the economy’s productive capacity, the result is an inevitable loss of the currency’s value [15].

Inflation as the Mechanism of Debasement

The consequence of this imbalance is widespread inflation, which acts as the functional manifestation of currency debasement. Inflation is not merely a rise in prices but a measurable loss of the currency’s ability to retain its value [15]. Some consider this type of inflation a hidden tax (See our Article on Is Inflation a Stealth Tax?). Data confirms this erosion: significant cumulative price increases over recent five-year periods have fundamentally lowered the purchasing power of the dollar [10].

The Debasement Trade views inflation as structural rather than temporary—a direct result of governments financing massive deficits through the printing press, effectively taxing the population through reduced purchasing power rather than legislative mandate.

US Inflation

Figure 3 Source: Federal Reserve

IV. Political Debate and the Precedent of the Plaza Accord

The current anxiety surrounding debasement is focused on specific policy discussions within Washington concerning the intentional manipulation of the dollar’s value.

The Deliberate Devaluation Thesis

Certain U.S. economic advisors, notably within the Trump administration, have argued that the dollar’s status as the world’s reserve currency creates a structural “overvaluation” that persistently harms U.S. trade competitiveness [16]. Proponents of this view suggest that managing a controlled depreciation of the dollar is a necessary measure to correct global trade imbalances and support domestic manufacturing [16].

This thesis has led to policy suggestions, sometimes grouped conceptually under the name “Mar-a-Lago Accord.” These suggestions include strategies such as utilizing tariffs to adjust global currency levels or even taxing foreign holders of U.S. Treasury debt [16]. Such discussions signal a willingness by policymakers to consider actions to achieve fiscal and trade goals, even at the expense of currency stability (Inflation).

Mar-a-Lago Accord

The Plaza Accord as Historical Parallel

These modern devaluation proposals directly reference the Plaza Accord of 1985.

- Purpose: The Plaza Accord was a multilateral agreement signed by the G5 nations (France, West Germany, Japan, the United Kingdom, and the United States) [17]. Its specific goal was to engineer an orderly depreciation of the U.S. dollar against the Japanese yen and German Deutsche Mark. At the time, the U.S. dollar was considered significantly overvalued due to high U.S. interest rates and robust capital inflows, which led to a massive U.S. trade deficit [18].

- Mechanism: The participating nations agreed to coordinate currency market interventions, specifically selling U.S. dollars, to achieve the desired depreciation [18].

- Outcome and Relevance: The Accord successfully achieved its short-term goal, weakening the dollar significantly [18]. However, it ultimately failed to deliver long-lasting correction to the underlying U.S. trade imbalances because the structural domestic factors—namely, low private savings and high government borrowing—remained unaddressed [19].

The historical parallel is crucial: while a new “accord” might temporarily achieve a devaluation target, the Debasement Trade argument suggests that without fundamental fiscal discipline, any managed decline will merely lead to renewed instability and require further monetary interventions.

The Official Stance

Despite the policy discussions, U.S. Treasury Secretary Scott Bessent has publicly distinguished between short-term currency fluctuations and long-term policy [20]. He maintains that the core of the U.S. “strong dollar policy” is to take long-term steps to ensure the dollar remains the world’s reserve currency, focusing on U.S. economic growth and stability, rather than obsessing over the exchange rate [20]. This distinction is intended to reassure global markets that the U.S. is not actively pursuing the dollar’s demise, even if domestic fiscal and monetary choices suggest otherwise.

V. Implications for Citizens and the Move to Hard Assets

The consequences of currency debasement are most keenly felt by the average citizen, whose financial well being may depend on the dollar’s stability. This is especially true after the post COVID rapid inflation period felt by most Americans who are now keenly aware of the negative impacts of inflation.

Inflationary Wealth Transfer

Debasement operates as a stealthy wealth transfer mechanism [21].

- Erosion of Fixed Income: Citizens holding dollar-denominated assets, such as savings accounts, fixed pensions, and bonds, see the real value of their wealth diminish steadily [7]. This is especially punitive for retirees and those on fixed incomes.

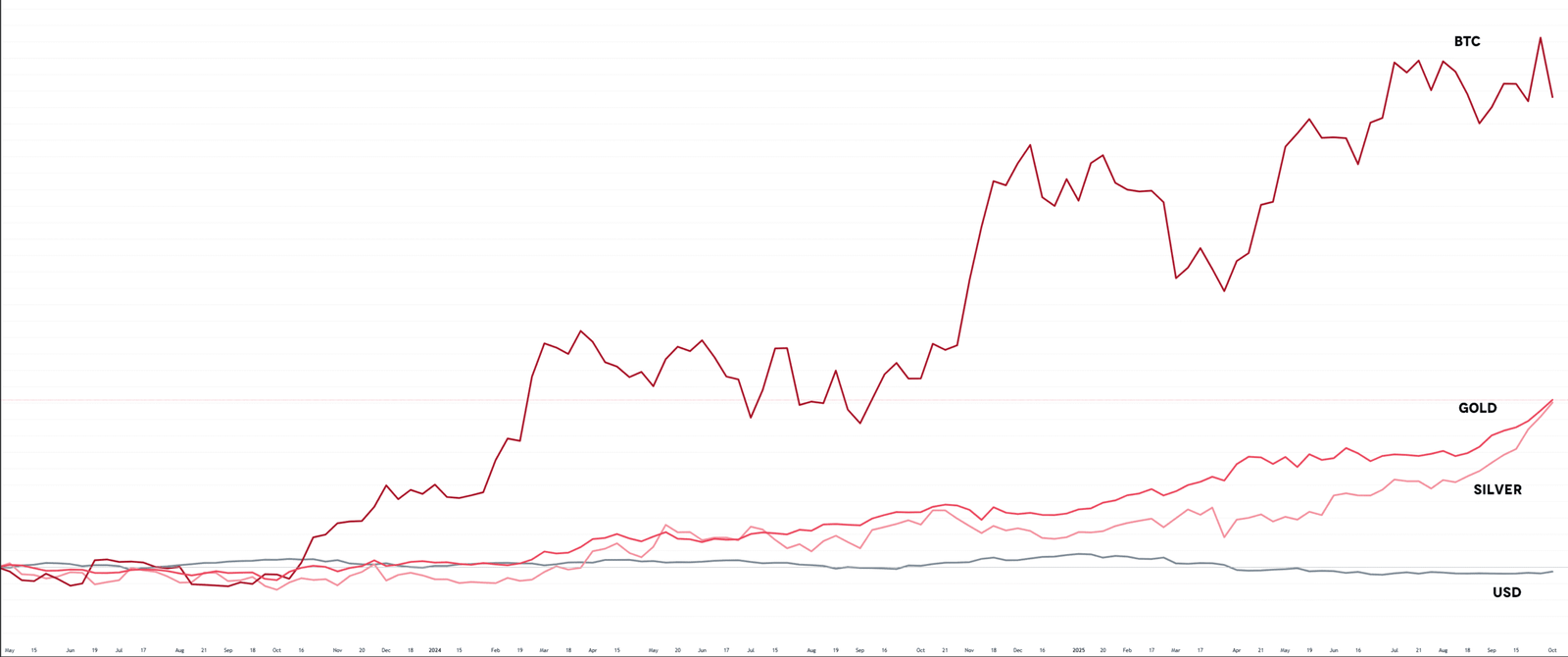

- Asset Price Distortion: While nominal asset prices (stocks, real estate) reach record highs in dollar terms, this surge is often an illusion. When these assets are measured against hard assets like Gold or Bitcoin, the appreciation is significantly tempered, reflecting the currency’s dilution rather than pure economic growth [22].

This disparity: those who are asset-rich (owners of real estate, commodities, or equities) are protected, while the working class and cash holders are negatively effected as their wages and savings buy less in real terms.

The Embrace of Hard Assets

The Debasement Trade is the strategic answer to this inflationary trap. Investors are choosing assets defined by their scarcity:

- Gold (Traditional Hedge): Gold has served as a reliable store of value and inflationary hedge for millennia, its value enduring precisely because it cannot be created by a central bank [23]. Surges in the gold prices directly reflect the decline in the dollar’s relative value [12].

- Bitcoin (Digital Scarcity): Bitcoin has been increasingly adopted as a contemporary hard asset [1]. Its maximum supply of 21 million coins is secured by cryptography and network consensus, rendering it immune to sovereign fiscal or monetary manipulation [2]. Its inclusion in the Debasement Trade reflects a redefinition of “hard money,” moving beyond the physical limitations of precious metals to the mathematical certainty of code [22]. The dramatic appreciation of Bitcoin is viewed by many investors not as a speculative frenzy, but as a rational re-pricing of mathematical scarcity relative to infinitely expanding fiat currency [1].

USD vs Hard Assets

VI. Conclusion: A Structural Shift

The Debasement Trade is more than a momentary market tactic; it is a structural investment shift reflecting deep seated concerns over fiscal integrity of the world’s leading economies. Driven by high and persistent debt accumulation, coupled with the unconstrained power of central banks to expand the money supply through QE, the trade represents a fundamental shift in investor trust, from faith in government promises to reliance on the verifiable scarcity of hard assets. As long as the structural imbalance between monetary creation and productive capacity persists, the strategic movement toward assets like gold and Bitcoin will continue to be a defining feature of the global financial landscape.

Citations and References

- The Guardian. (2025, October 9). ‘The debasement trade’: Is this what’s driving gold, bitcoin and shares to record highs? https://www.theguardian.com/business/2025/oct/09/the-debasement-trade-is-this-whats-driving-gold-bitcoin-and-shares-to-record-highs (The Guardian)

- XTB. (2025, October 9). Debasement trade: Why investors seek refuge in gold. https://www.xtb.com/int/market-analysis/news-and-research/debasement-trade-why-investors-seek-refuge-in-gold (XTB.com)

- Investopedia. (2024). What is currency debasement, with examples. https://www.investopedia.com/terms/d/debasement.asp (Investopedia)

- Encyclopaedia Britannica. (n.d.). Debasement (monetary theory). https://www.britannica.com/topic/debasement (Encyclopedia Britannica)

- Munro, J. H. (2010). The coinages and monetary policies of Henry VIII (r. 1509–1547) and Edward VI (r. 1547–1553). University of Toronto Department of Economics Working Paper No. 417. https://www.economics.utoronto.ca/public/workingPapers/tecipa-417.pdf (Department of Economics)

- Westminster Wealth Management. (2025, October 8). Understanding the “debasement trade” on Wall Street. https://www.westminsterwm.com/blog/understanding-the-debasement-trade-on-wall-street (westminsterwm.com)

- DPAM. (2025, April 23). The hidden cost of monetary debasement. https://www.dpaminvestments.com/professional-end-investor/at/en/angle/the-hidden-cost-of-monetary-debasement (dpaminvestments.com)

- FinancialContent. (2025, October 7). Investors flee U.S. dollar for bitcoin and gold amidst ‘debasement trade’ warnings from Citadel CEO Ken Griffin. https://www.financialcontent.com/article/marketminute-2025-10-7-investors-flee-us-dollar-for-bitcoin-and-gold-amidst-debasement-trade-warnings-from-citadel-ceo-ken-griffin (FinancialContent)

- Fair Observer. (2025, October 5). FO° Exclusive: US dollar will continue to lose value. https://www.fairobserver.com/economics/fo-exclusive-us-dollar-will-continue-to-lose-value/ (Fair Observer)

- Mitrade. (2025, October 7). Citadel’s Ken Griffin says gold, silver, BTC lead ‘debasement trade’. https://www.mitrade.com/insights/news/live-news/article-3-1176417-20251007 (Mitrade)

- Morgan Stanley. (2025, August 6). Devaluation of the U.S. dollar 2025. https://www.morganstanley.com/insights/articles/us-dollar-declines (Morgan Stanley)

- The Economic Times. (2025, October 8). U.S. stock futures today: Dow, S&P 500, Nasdaq flat amid AI bubble fears as gold surges past $4,000 — check which stocks are surging and sinking now. https://m.economictimes.com/news/international/us/u-s-stock-futures-today-october-8-2025-dow-sp-500-nasdaq-flat-amid-ai-bubble-fears-as-gold-surges-past-4000-check-which-stocks-are-surging-and-sinking-now/articleshow/124383646.cms (The Economic Times)

- J.P. Morgan Research. (2025, July 1). De-dollarization: The end of dollar dominance? https://www.jpmorgan.com/insights/global-research/currencies/de-dollarization (JPMorgan Chase)

- McMillin, R. (2025, October 7). Gold, bitcoin and the debasement trade. Livewire Markets. https://www.livewiremarkets.com/wires/gold-bitcoin-and-the-debasement-trade (Livewire Markets)

- Roberts, L. (2025, August 4). Debasement explained: What it is—and what it’s not. Advisorpedia. https://www.advisorpedia.com/markets/debasement-explained-what-it-is-and-what-its-not/ (Advisorpedia)

- The Mining Journal (Editorial Board). (2025, August 16). Trump’s pick wants to devalue dollar. https://www.miningjournal.net/opinion/editorial/2025/08/trumps-pick-wants-to-devalue-dollar/ (miningjournal.net)

- TD Economics. (2025, May 1). The non-starter playbook of the Mar-a-Lago Accord. https://economics.td.com/us-mar-a-lago-accord (PDF: https://economics.td.com/domains/economics.td.com/documents/reports/ms/Mar-a-Lago_Accord.pdf) (TD Economics)

- Investopedia. (n.d.). Plaza Accord: Definition, history, purpose, and its replacement. https://www.investopedia.com/terms/p/plaza-accord.asp (Investopedia)

- Frankel, J. (2015, December). The Plaza Accord, 30 years later (NBER Working Paper No. 21813). National Bureau of Economic Research. https://www.nber.org/papers/w21813 (PDF: https://www.nber.org/system/files/working_papers/w21813/w21813.pdf) (NBER)

- Webull (syndicated from Bloomberg/Benzinga). (2025, July 3). U.S. Treasury Secretary Bessent refuted claims that the recent depreciation of the U.S. dollar would affect its status as the world’s major currency. https://www.webull.com/news/13098149616067584 (Webull)

- Opening Bell Daily. (2025, October 6). Everything rally is a mirage next to the debasement trade. https://www.openingbelldailynews.com/p/bitcoin-stock-market-outlook-debasement-trade-jpmorgan-wall-street-investors (Opening Bell Daily)

- GRAVITAS. (2025, October 8). Investors turn to gold, silver, and BTC in ‘debasement trade’ [Video]. YouTube. https://www.youtube.com/watch?v=_Pde-sodiyE (YouTube)

- Investopedia. (2025, October 7). Investor anxiety fuels gold’s rise: Understanding the ‘debasement trade’. https://www.investopedia.com/what-is-the-debasement-trade-and-why-does-it-matter-gold-bitcoin-11825589 (Investopedia)