Social Security Review

Social Security has long been considered the “third rail” of American politics—untouchable and too risky to reform. After all, millions of Americans have worked a lifetime counting on certain commitments. Changing it after decades of hard work is a difficult political maneuver and not typically well tolerated. But as the program’s financial sustainability erodes, and younger generations increasingly question whether they’ll ever see a return on their payroll taxes (60% between 18-49 don’t believe [23]), calls for partial or full privatization are resurfacing. While once dismissed as politically radioactive, the idea of allowing individuals to invest part of their payroll taxes into private accounts is gaining traction—not only among free-market economists but also younger Americans facing record debt, housing costs, and generational inequity.

This article examines the Social Security program’s origin and challenges, the structure and results of its pay-as-you-go model, the growing unfunded liabilities, and the comparative outcomes of private investment alternatives. We explore real-world comparisons with other OECD Countries systems, provide Treasury Secretary Scott Bessent’s position, and quantify the impact of Social Security on the federal budget and intergenerational equity. The article looks at the Pros and Cons of each position, and provides a comparison.

Social Security Origins: A New Deal Legacy

Social Security was established in 1935 under President Franklin D. Roosevelt during the Great Depression. It was designed as a social insurance program to provide financial support to retirees, widows, and the disabled. The system relies on current workers’ payroll taxes to pay benefits to current retirees, forming a “pay-as-you-go” structure (PAYGO, PAYG) rather than a traditional investment-based pension. The PAYGO system relies on the Government to pay these as budget expenses from tax revenue versus a Private Retirement Account that accumulates value over time and pays for itself.

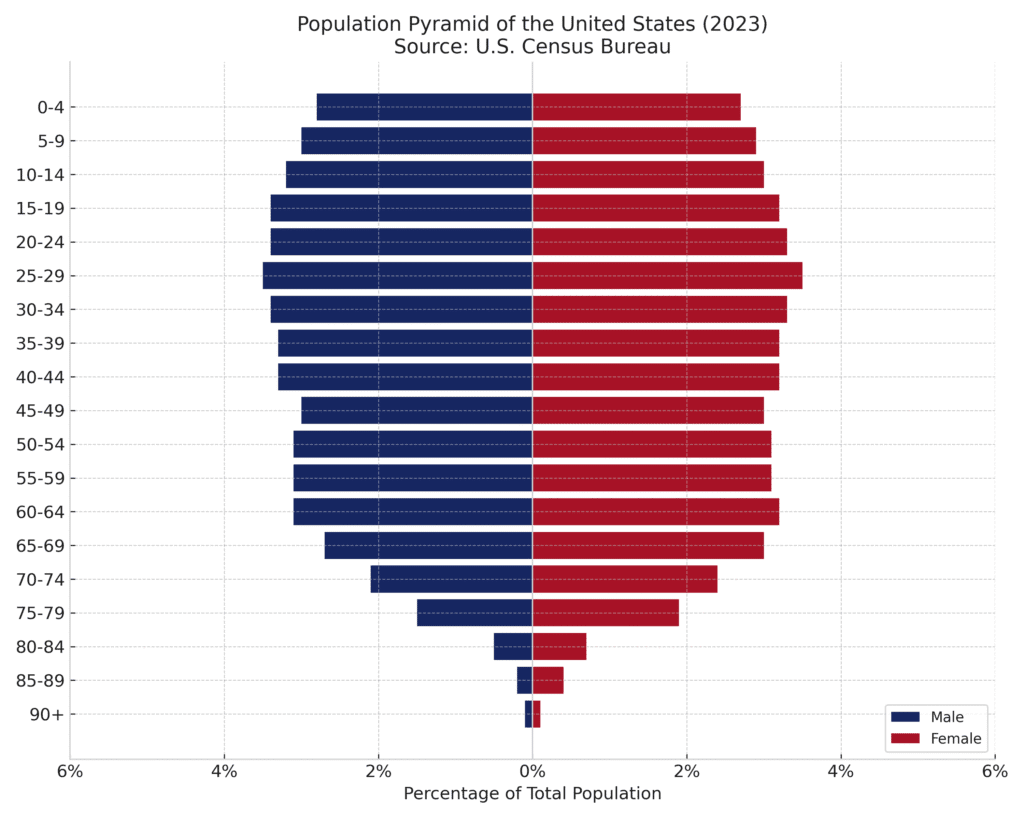

However, the economics of the original program are starting to have some structural challenges that are not easily overcome. Originally, Social Security had 42 workers supporting each retiree. Today, that ratio is closer to 2.7 and falling, a demographic shift that has made the system increasingly unstable [1], especially as the Population pyramid shifts (See Figure 1).

The Math Problem: Pay-As-You-Go and Unfunded Liabilities

Unlike private retirement accounts that accumulate assets over time, Social Security operates as a transfer program. The payroll taxes paid today are not saved or invested for the contributor’s future—they are immediately redistributed to current beneficiaries, this is the Pay-as-you-Go system (often referred to as PAYGO or PAYG).

The key problem with this structure is demographic: as birth rates decline and life expectancy increases, fewer workers are supporting more retirees. This has produced a growing imbalance. According to the Social Security Trustees’ 2024 report, the program faces an unfunded liability of $22.6 trillion over the next 75 years [2].

Unless major changes occur—either through tax increases, benefit reductions, or structural reform—Social Security is projected to exhaust its trust fund by 2033. At that point, benefits would be automatically reduced by an estimated 23% across the board [3]. This would obviously have major, and negative consequences on many Americans that depend on these payments, and likely be seen as a betrayal on commitments made to them for a lifetime of work.

Demographics not on Social Securities Side

As Lifespans increase the U.S. population is getting older and retired citizens continue to increase as a percentage of the population intensifying Social Security’s funding crisis. As of 2024, individuals under 18 comprise about 21.5%, ages 18–44 about 36%, ages 45–64 about 24.6%, and those 65+ around 18% of the total population. [12]

That shrinking working-age cohort (15–64) relative to retirees creates a high dependency ratio. With fewer contributors supporting more beneficiaries, the strain on the system continues to rise. Since Social Security is a Pay as you Go system and not based on investments that have appreciated over time, if you have an imbalance of working age Payers versus older retired beneficiaries the system begins to fall apart economically without restructuring. This is a Worldwide phenomenon as life expectancies continue to increase and countries that have adopted a Pay as you Go system are exposed to demographic shifts that create challenging economics. In general, for these systems to work you must have a wider middle supporting a tapering, and smaller group in retirement.

Investment Alternative?

So, economically, how does a Privatized system work versus our current Social Security System? To understand the opportunity cost of the current system, consider by comparison a median-income worker contributing the same amount to a private investment account instead of Social Security. The Social Security tax rate is currently 12.4%, split evenly between employee and employer. For a median income of $60,000 (in 2024), that’s $7,440 annually.

Assumptions:

- Starting at age 22, retiring at 67

- $60,000 annual wage, growing at 1.5% real wage growth

- Contributions: 12.4% of wages invested in an S&P 500 index fund

- Historical S&P 500 average real return: 7% [4]

| Metric | Social Security | Private Investment |

|---|---|---|

| Total Contributions (nominal) | $500,000+ | $500,000+ |

| Monthly Retirement Income (estimated) | $1,800–$2,000 | $6,000–$8,000 |

| Total Lifetime Benefit | ~$500,000–$600,000 | ~$1.5M–$2.5M+ |

It should be noted, that this is a simple example is using mid range income citizens, and does not model the upper and lower incomes which can have significantly different outcomes. It should also be noted that the Private account is exposed to much higher market risks, than a Government backed account, and there are no guarantees of Market performance, or loss of principle. However, as a base example it is clear that the Private solution substantially outperforms the Social Security program, providing up to 4 times the income (See Figure 2, 3). This obviously could be life changing for many individuals, from barely managing to get by to living a more comfortable life in their retirement.

Comparing Private Investment vs Social Security

The compound returns of a private investment account (indexed to the S&P 500) dramatically outpaces the flat benefit structure of Social Security. Even adjusted for inflation and risk, the delta is significant.

This was only an example, your exact numbers will differ based on your income and contributions. If you wish to calculate on your own you may try these resources:

- Use Calculator: https://www.ssa.gov/estimator/

- Calculate by Hand: https://www.ssa.gov/OACT/cola/piaformula.html

Why the Gap? Redistribution

This delta in outcomes, as shown in Figures 2 and 3, exists for a reason. Social Security was not designed as an investment vehicle – it’s a redistributive social insurance scheme. High-income earners subsidize lower-income earners. Healthy workers subsidize disabled ones. Individuals with longer life expectancies (often wealthier, healthier demographics) benefit more than those who die earlier.

This redistribution is intentional. Roughly 20% of Social Security benefits go to survivors and disabled individuals. The rest is retirement support—but even this is progressive: a low-wage worker receives a higher replacement rate (often 90% of their income) than a higher-wage worker (25–40%) [5]. Social Security is not a retirement plan per se, but a tax to create a Social Safety net to distribute money to those in greater need.

Global Comparison of Retirement Benefit Plans

America is not alone in providing Retirement Benefit plans, here is a comparison of the Top 25 OECD countries by GDP Retirement Benefit programs.

| Country | Model (Gov’t System) | Mandated Supplemental | Funding Method | Solvency Issues | Return Rate |

|---|---|---|---|---|---|

| United States | Public | None (voluntary 401(k) excluded) | PAYG | High | Low |

| Japan | Public | National Pension + GPIF reserve | PAYG + Asset-Backed | Medium | Medium |

| Germany | Public | Statutory + Emerging Asset Fund | PAYG + Partial Reserves | Medium | Low |

| United Kingdom | Public | Auto-Enrolled Private Pensions | PAYG + Mandatory DC | Low | Medium |

| France | Public | Mandatory Supplementary | PAYG | Medium | Low |

| Canada | Public | CPP (Asset-Backed, Mandatory) | Asset-Backed | Low | Medium |

| Italy | Public | None (Voluntary Private Optional) | PAYG | High | Low |

| South Korea | Public | Basic Pension | PAYG | High | Low |

| Spain | Public | None (Voluntary Only) | PAYG | High | Low |

| Australia | Hybrid | Superannuation (Mandatory DC) | Asset-Backed | Low | High |

| Netherlands | Hybrid | Mandatory Occupational DC | Asset-Backed | Low | High |

| Mexico | Public | Mandatory AFORE (DC) | Asset-Backed | Medium | Medium |

| Switzerland | Hybrid | Mandatory Pillar 2 DC | Asset-Backed | Low | Medium |

| Sweden | Hybrid | Mandatory Premium Pension DC | PAYG + Asset-Backed | Low | High |

| Poland | Public | Employer PPK (Mandatory Opt-Out) | PAYG + Partial DC | Medium | Low |

| Belgium | Public | None (Voluntary Private Optional) | PAYG | Medium | Low |

| Austria | Public | None (Voluntary Private Optional) | PAYG | Medium | Low |

| Norway | Public | Oil Fund Reserves (Public Use) | PAYG + Sovereign Fund | Low | High |

| Ireland | Public | None (Auto-enrollment pending) | PAYG | Medium | Low |

| Denmark | Hybrid | ATP + Occupational Mandatory DC | Asset-Backed | Low | High |

| Finland | Hybrid | Mandatory Public + Reserve | PAYG + Asset-Backed | Low | Medium |

| Portugal | Public | None | PAYG | High | Low |

| Czech Republic | Public | None (Voluntary Private) | PAYG | Medium | Low |

| Greece | Public | None | PAYG | High | Low |

| Hungary | Public | None | PAYG | High | Low |

Note that all the Top OECD countries, unlike countries like Chile which are fully privatized, have some sort of either a Public or Hybrid (Public/Private) Retirement Benefit plan. The countries with LOW solvency risk all have some type of Asset Backed solution where investments are made that grow over time, except for Norway which essentially has the same with their National Sovereign Wealth Fund, the largest in the World, contributing instead of individuals. It should also be noted, some what paradoxically, that ALL of the countries that pay High rates of return to their Beneficiaries (highlighted in green on Table 2) ALSO all have LOW Solvency issues, the best of both worlds. Lower financial risks, higher returns using some type of Asset Backed system. In contrast, note the many countries with Public plans with PAYG models that have high HIGH solvency risks, and LOW payouts. The worst of all worlds, and unfortunately that is where America stands today.

Budgetary Impact: Growing Expense, No Asset

From a Federal budget perspective, Social Security is the single largest budget item with $1.4 trillion in outlays in FY 2024, accounting for roughly 20% of total federal spending [8].

Critically, Social Security is not a government asset. It does not generate returns or grow the nation’s wealth—it is a liability that increases over time, as benefit obligations rise with demographics. Unlike a sovereign wealth fund or private asset backed investments, Social Security has no capital base, it is not invested and does not grow in value. It is an ever-growing expense that is a liability for our Government, not a revenue-generating investment.

This funding gap, creates a solvency issue for the fund, and projections already anticipate reduced payouts by 2033 [3]. This will require either new sources of revenue (taxes), reduced payouts, or higher eligibility requirements (higher retirement ages). For many people these are unacceptable outcomes.

Privatization: Arguments Against

Social Security has become a critical component of American lives, and the thought of change is scary. It is meant as a Social Safety Net and anything that minimizes that security, and increases risk is viewed rightly with concern. Critics of privatizing Social Security raise concerns of risk, fairness, and protecting the most vulnerable.

1. Loss of the Redistributive Function

Social Security is not just a retirement program—it’s a progressive, redistributive system that transfers income across generations and income levels.

- From higher earners to lower earners (due to progressive benefit formulas)

- From healthy individuals to those with disabilities or survivors

- Across gender and racial wealth gaps

Privatization, by design, makes benefits directly proportional to contributions and investment returns, which eliminates these transfers. This could weaken the social contract, especially for groups who rely most heavily on the system—such as lower-income workers, women, minorities, and the disabled.

2. Erosion of the Universal Safety Net

The current system provides guaranteed income, indexed to inflation, for life. This protects against:

- Longevity risk (outliving one’s assets)

- Market risk (mismanagement of assets or retiring into a downturn)

- Cognitive decline (mismanaging funds in old age)

- Disability (declining or limited physical abilities shorten working career)

- Wealth Gap (offset lower income participants with relatively higher benefits than higher income groups)

- Security (Income for the life of the beneficiary guaranteed)

- Spousal (Income for dependent widowed spouses)

Depending on the implementation, Private accounts would shift this burden to individuals, many of whom may lack financial literacy or stability to manage these risks. Even with lifecycle funds and default allocations, the system would no longer guarantee baseline income, exposing millions to potential poverty in old age.

3. Market Volatility and Distributional Inequality

While long-run market returns are historically strong, retirement outcomes under private accounts would vary significantly based on:

- Career timing (Market returns vary considerably based on time period e.g., retiring in 2009 vs. 2021)

- Investment choices and fees (Loss of principle, poor investment decisions can greatly effect outcomes)

- Economic cycles and policy shocks (Macro economic cycles and events like Covid or Wars can greatly impact returns)

Markets are inherently riskier, and Privatization would transfer this risk from the government to the participant. This also introduces intra-generational disparities – two workers with identical careers and investments could end up with vastly different outcomes. Such disparities undermine the risk-pooling foundation of Social Security.

4. Administrative Complexity and Cost

Privatized systems, especially those with choice, may entail higher a variety of extra costs that would be born by the participant.

- Recordkeeping costs

- Regulatory oversight needs

- Fraud risks (e.g., predatory financial products)

- Financial Service fees (e.g. Brokers, Financial Planners, Asset Managers, Transaction Fees, etc.)

While centralized custodial platforms managed by the Government can mitigate this, this can all add costs. Currently, the U.S. lacks the institutional infrastructure to support this function.

Privatization: Arguments For

Proponents of private investment accounts argue that the objections to privatization, while valid, are either addressable through design or outweighed by the substantial gains in individual and National financial outcomes. That privatization can increase the material wealth of the country, and put the Nation on a better fiscal course, and that it matches our countries philosophical principles of liberty and ownership.

1. Higher Long-Term Returns and Quality of Life

- S&P 500 index funds have returned 6–7% real annually historically, far outpacing the 0–2% implicit return Social Security provides many younger or higher-income workers.

- This delta compounds over decades. A median-income worker could retire with 3x or better lifetime income under private investment—even after inflation dramatically improving the quality of life for some populations.

- These higher balances could allow for:

- Earlier retirement (retirement is about wealth, not age)

- Higher consumption in retirement (being able to afford more of the things that add to a quality life)

- Improved generational quality of life (being able to pass wealth between generations instead of take it)

2. Intergenerational Wealth Transfer and Ownership

- Social Security benefits terminate at death. There is no residual asset to pass on.

- Private accounts create inheritable wealth—allowing families, particularly in lower-wealth communities, to build intergenerational assets and break the cycle of dependency.

3. Promotes Individual Liberty and Economic Agency

- Privatization returns control to individuals, allowing them to decide how their retirement assets are invested.

- This aligns with broader American values of personal choice, property rights, and economic freedom.

4. Transforms a Fiscal Liability into a National Asset

- Social Security is currently a growing budgetary liability, with unfunded liabilities exceeding $22 trillion [21].

- Private accounts would instead become national household assets, increasing capital formation, savings rates, and investment capacity -similar to the effect of Australia’s superannuation system, which now manages over $2.5 trillion in assets [22].

5. Mitigated Market Risk with Sound Design

- Critics overstate market risk in multi-decade investment horizons. Over any 40-year period in U.S. history, a diversified equity portfolio has never yielded a negative real return and has significantly outperformed Social Security funding.

- Risks can be reduced or neutralized via:

- Lifecycle/default funds

- Mandatory annuitization

- Capital buffers

- Minimum return guarantees (e.g., 2% real floor)

- Subsidization of at-risk groups via general revenues or redistribution of Capital Gains from Privatization

6. Fixes System Insolvency Without Raising Taxes

- Privatization bypasses the demographic death spiral of the current pay-as-you-go model.

- Instead of higher payroll taxes or benefit cuts, reformers propose transitioning to funded accounts over time, optionally grandfathering current retirees.

- Reform shifts the structure from intergenerational transfer to self-funded savings, improving long-term solvency and fairness.

7. Localized Equity Support Through Public Custody Models

- Inspired by Sweden’s PPM system, custodial platforms can be public, ensuring fee transparency, fraud protection, and mandated passive allocations.

- In the U.S., excess capital gains or fund growth could be redirected toward targeted supports (e.g., low-income workers, disabled populations, disaster relief) without sacrificing long-term solvency.

Comparing Private Investments versus Social Security

| Item | Social Security | Private Account |

|---|---|---|

| Risk | Guaranteed by Full Faith of US Government and the unlimited ability to Tax. | Exposed to Market, can gain and lose principle, much more volatile. |

| Guarantees | Fully Guaranteed, but dependent on Government Formula which can change. | No guarantees, based on Market returns. Can lose principle. |

| Performance | Not invested, based on Social Security formula to contribute. Very Low effective equivalent return. | Equity Market based returns outpace other investments. Much higher historical returns for long term investments. |

| Equity | You own nothing, at death you can not transfer assets. | Assets are owned by individual, can be transferred to beneficiaries. |

| Asset or Liability | Liability – Social Security is an expense that each year must be paid from current Taxes to Beneficiaries. | Asset – The Government would have no liability, and the value would become an Asset to the Beneficiary. |

| Unfunded Liability | As a Liability, shortfalls in revenues versus future payouts become unfunded liabilities | No Liabilities |

| Generational Wealth | Not an asset, so wealth can not be passed on. | Assets can be passed on, increasing Generational Wealth. |

| Social Safety Net | Provides Lower Income, and Disabled Citizens a Social Safety Net to provide some income, and potentially higher than their contributions. | Does not natively provide Social Safety Net. May help some at risk with higher incomes, but does not address Low Income or Disability. Programs could be setup to address. |

| Administration and Regulation | Centrally administered by Government, highly Regulated by Congress | To be determined, but likely a combination of Government regulation and administration in conjunction with Private Enterprises to administer program and set guidelines on acceptable plans to reduce risks. |

| Fraud & Abuse | Overall low, but significant amounts. From 2015-2022 improper payments of $72 billion. [13] | To be determined, but investment fraud, and abuse happen in our current financial system and this will be no different. |

| Retirement Age | As a Pay As You Go system, Social Security requires more workers to pay for beneficiaries, putting pressure to keep Retirement ages high especially as the retirees makeup larger portions of population. | Likely a Privatized system would have requirements. However, retirement is NOT about age, it is a about wealth. If you have achieved your asset growth, you could retire early, potentially much earlier than Social Security mandated dates. |

| Fixed Income | Social Security Provides a Fixed Income guarantee for the lifetime of the beneficiary. This means it can’t go down, but also that it doesn’t go up (there are periodic Cost of Living adjustments, but for the most part it is static). | Private accounts do not have Fixed Income guarantees. If you live longer, or have lost principle you are at higher risk. However, you can also have your principle and assets continue to grow, and have much higher assets and income to draw from. |

Did the Trump Administration let the Cat out of the Bag?

While not a formal policy announcement from the Trump Administration, in remarks this past week, current US Treasury Secretary Scott Bessent discussed the idea of private retirement accounts as a solution to long-term fiscal imbalances.

“We’ve allowed Social Security to drift too far from its roots. The average American would be far better off with a real investment account – especially if they own it, can pass it on, and see it grow.” [10]

Treasury Secretary Bessent, a former Chief Investment Officer of Soros Fund Management, noted:

“Social Security could be partially privatized by giving younger workers the option to invest a portion of their payroll tax into low-cost index funds. Over 40 years, the compounding returns would generate far more wealth than the current system, which is essentially insolvent.” [6]

Bessent views private accounts not only as more financially sustainable but also as a path toward wealth-building for younger and disadvantaged Americans who are currently locked into our current Social Security System that is a low-yield, Pay-as-you-go system.

“In a way, it is a back door for privatizing Social Security,” “If, all of a sudden, these accounts grow and you have in the hundreds of thousands of dollars for your retirement, that’s a game changer, too.” [11]

While this topic has been passed around in policy discussions for a long time, privatization has always brought out fears, and opposition.

Conclusion: The Cat May Already Be Out of the Bag

Social Security reform is no longer an ideological debate—it is an actuarial necessity to keep the system solvent. The system’s financial path is unsustainable, and young Americans increasingly question whether they are paying into a program that will exist when they retire.

The Tax Project does not weigh into the debate, just presents facts and data, and hopes that Smarter more informed Citizens help make their choices. To some, the choice maybe obvious, for others the fear and risks of changes outweigh any gains. All have valid concerns and points. What is clear, is that the US Social Security program has structural challenges that won’t be resolved without some types of reform, and that delaying or ignoring the problem has not helped the challenge. There are working models out there, and we believe that Americans when presented with facts and data will always make the best choices. We will always bet on America’s Future.

Citations

[1] Social Security Administration, “Social Security Basic Facts,” https://www.ssa.gov/news/press/basicfact.html

[2] 2024 Trustees Report Summary, https://www.ssa.gov/OACT/TR/2024/tr24summary.pdf

[3] Congressional Budget Office, “The Outlook for Social Security,” 2023

[4] Jeremy Siegel, “Stocks for the Long Run,” McGraw Hill (2020 Edition)

[5] Center on Budget and Policy Priorities, “Policy Basics: Top Ten Facts about Social Security,” https://www.cbpp.org

[6] CNBC, “Scott Bessent on Social Security Privatization,” interview archive, 2023

[7] Swedish Pensions Agency, “Premium Pension System Overview,” https://www.pensionsmyndigheten.se

[8] U.S. Office of Management and Budget, FY 2024 Budget, https://www.whitehouse.gov/omb

[9] Urban Institute, “Social Security and the Rate of Return,” https://www.urban.org

[10] Washington Post, https://www.washingtonpost.com/business/2025/07/30/trump-accounts-social-security-bessent/

[11] Reuters, https://www.reuters.com/legal/government/bessent-calls-trump-baby-accounts-backdoor-privatizing-social-security-2025-07-30/

[12] Marketwatch, https://www.marketwatch.com/story/dont-say-you-want-to-privatize-social-security-say-you-want-to-break-it-up-980a815d

[13] OIG, https://oig.ssa.gov/news-releases/2024-08-19-ig-reports-nearly-72-billion-improperly-paid-recommended-improvements-go-unimplemented/

[14] OECD (2023). Pensions at a Glance 2023. Organisation for Economic Co-operation and Development. https://www.oecd.org/pensions/pensionsataglance.htm

[15] World Bank (2022). Pension Reform Primer. World Bank Group. https://www.worldbank.org/en/topic/pensions

[16] International Social Security Association (2024). Country Profiles. ISSA. https://ww1.issa.int/country-profiles

[17] Mercer (2023). Mercer CFA Institute Global Pension Index 2023. Mercer. https://www.mercer.com/en-us/insights/global-pension-index/

[18] U.S. Social Security Administration (2024). International Programs – Country Information. SSA. https://www.ssa.gov/international/

[19] European Commission (2023). The 2023 Ageing Report: Economic and Budgetary Projections for the EU Member States (2022–2070). https://economy-finance.ec.europa.eu

[20] International Monetary Fund (2024). Fiscal Monitor: Budgeting for a Better Future. IMF. https://www.imf.org/en/Publications/FM

[21] Trustees Report, Social Security Administration, 2024

[22] Australian Prudential Regulation Authority, Superannuation Statistics, June 2024

[23] Gallup, Aug 2015 https://news.gallup.com/poll/184580/americans-doubt-social-security-benefits.aspx