Urgent call for change or more of the same?

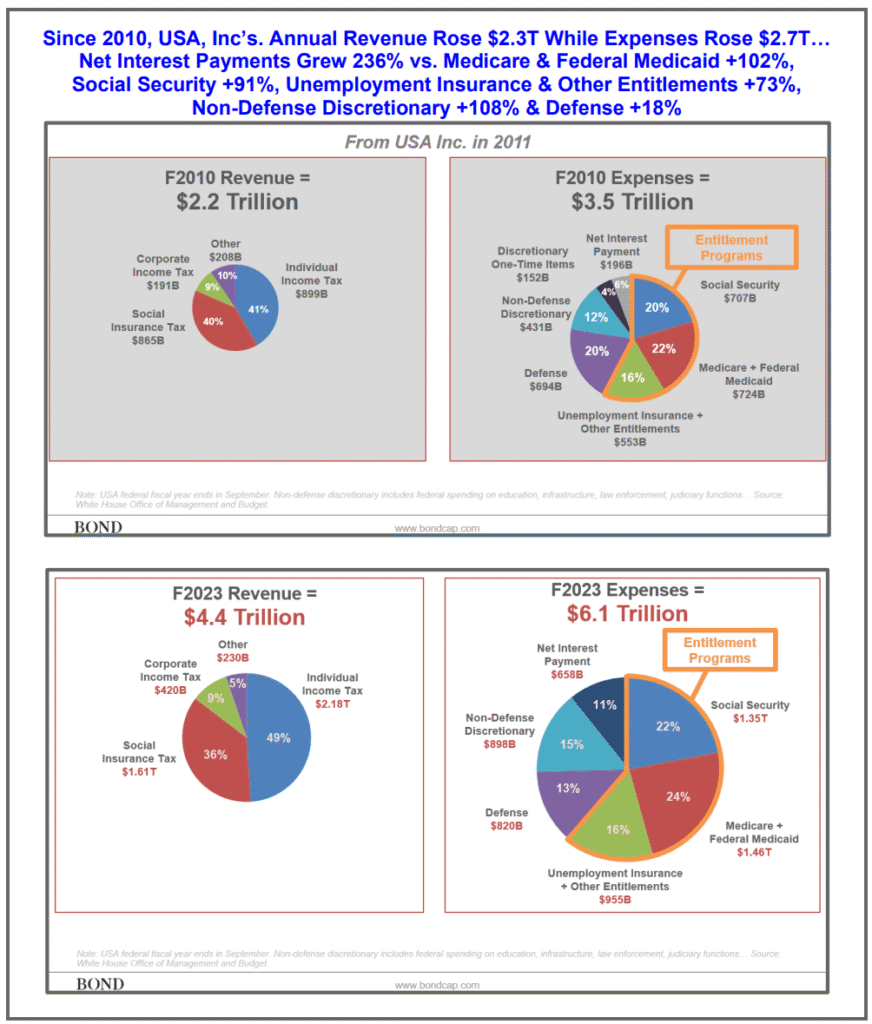

Mary Meeker’s highly anticipated “USA, Inc.” report, released in March 2025 by Bond Capital, once again delivered a meticulously researched financial assessment of the United States. Following her seminal 2011 “USA Inc.” report, this 2025 iteration provides a critical updated snapshot, viewing the U.S. federal government through the lens of a corporate balance sheet and income statement. The core message remains consistent: America’s fiscal trajectory is a pressing concern, though the urgency and prescribed solutions vary wildly depending on one’s economic philosophy.

The original 2011 “USA Inc.” report served as a stark wake-up call, highlighting accelerating debt accumulation and growing unfunded liabilities, particularly in Social Security and Medicare [1]. It laid out a business-like accounting of the nation’s finances, suggesting that without significant changes, the U.S. was heading towards an unsustainable path.

Themes and Key Findings from USA, Inc. 2025

Fast forward to March 2025, and the latest “USA, Inc.” report paints a picture of deepening fiscal challenges. The delta from 2011 is not merely a quantitative increase in debt; it’s a qualitative shift where previously projected liabilities have materialized and accelerated, exacerbated by recent global events and policy responses.

Key findings and themes from the USA Inc. 2025 report:

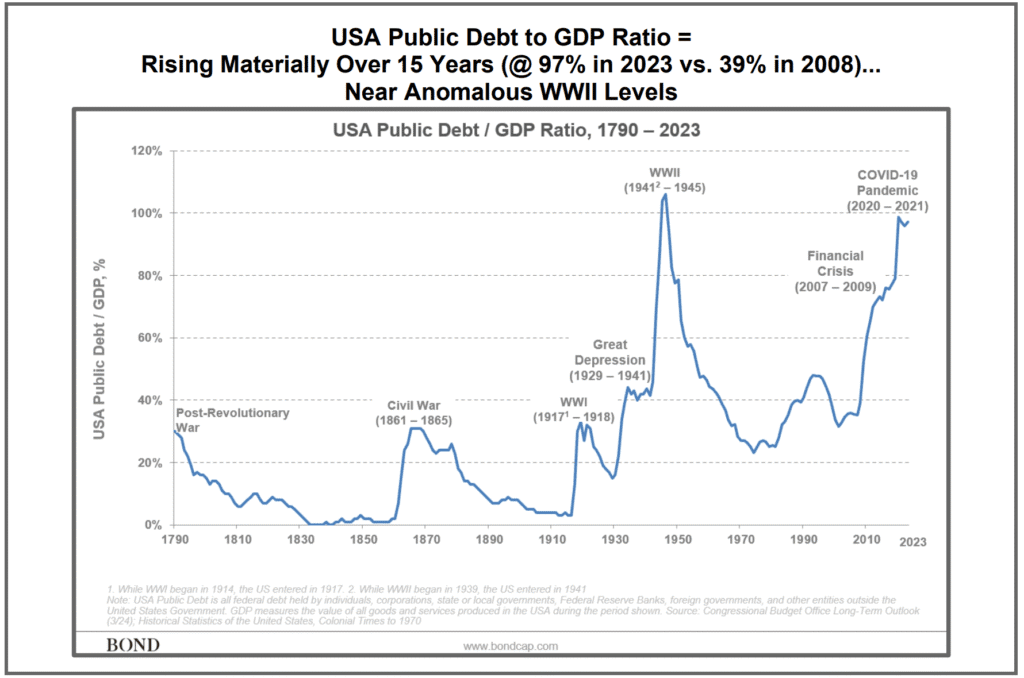

- Escalating National Debt: The national debt has surged to levels exceeding historical peaks relative to GDP, projected to continue its upward trajectory [2]. Figure 3

- Crowding Out by Interest Payments: A significant and alarming finding is the rapid growth in net interest payments on the debt, which are now consuming an ever-larger portion of the federal budget, crowding out other critical federal investments like infrastructure, education, or defense [3]. Figure 4

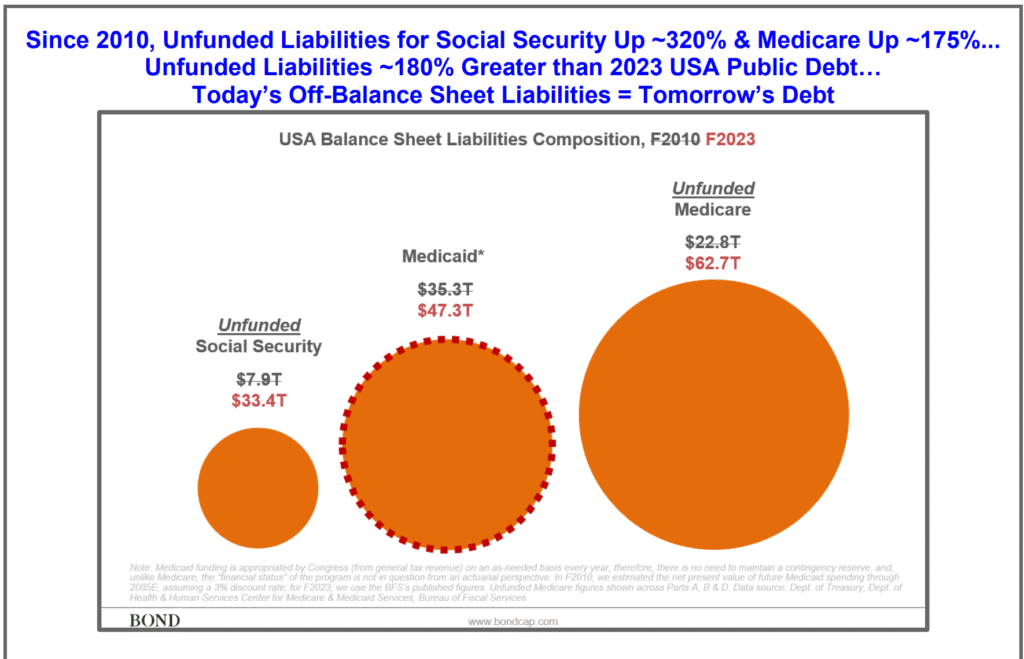

- Accelerated Unfunded Liabilities: The “epic” and rising nature of off-balance sheet liabilities, primarily for entitlements like Social Security and Medicare, continues to be a central theme. These commitments amount to multiples of the on-book debt, a warning bell that was already ringing in 2011 but is now blaring louder [1, 4]. Figure 2

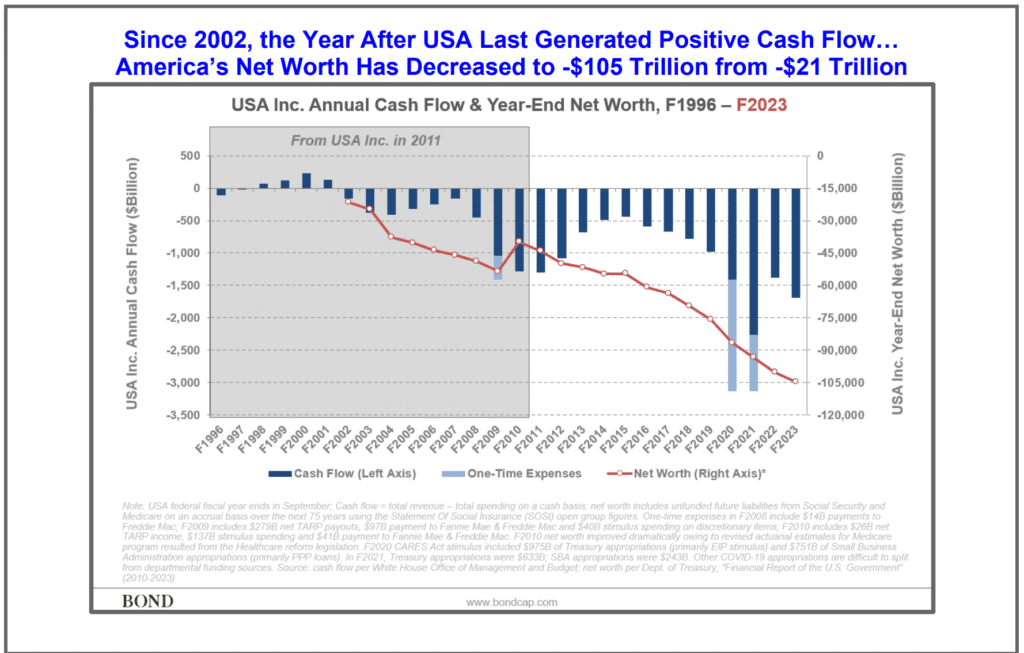

- Deteriorating Net Worth: Mirroring a corporate entity, the report likely shows a continued deterioration of USA Inc.’s net worth, implying a diminished financial flexibility to handle future national crises or unexpected economic shocks [1]. Figure 1

Economic Interpretations: A Spectrum of Views

This grim outlook, however, isn’t universally accepted. Mainstream economics broadly encompasses traditional (neoclassical) views and Keynesian economics. Traditional economists often emphasize the importance of balanced budgets, fiscal discipline, and minimal government intervention, fearing that large deficits lead to crowding out of private investment and inflationary pressures. Keynesian economics, while acknowledging the long-term need for fiscal sustainability, emphasizes the role of government spending in stimulating demand during economic downturns, arguing that deficits can be beneficial when the economy is operating below its potential.

Modern Monetary Theory (MMT) represents a more heterodox, almost “post-Keynesian,” perspective. MMT posits that a sovereign government, which issues its own fiat currency, cannot technically “run out of money” and therefore isn’t constrained by debt in the same way a household or business is [6]. From an MMT perspective, the numbers presented in “USA, Inc.” might be seen not as an impending crisis, but rather as an accounting of necessary public spending to achieve societal goals, with inflation being the true constraint, not debt levels. Proponents of MMT would likely argue that government spending creates the very financial assets that fund the debt, and that fears of “crowding out” are overblown for a currency issuer [6].

Support for MMT remains a minority view [10] within the broader economics community. While it has gained increased public discussion, particularly since the 2008 financial crisis and in response to discussions around large-scale public spending, most mainstream economists, including many Keynesians, remain skeptical of its core tenets regarding government debt limits. They typically acknowledge a currency-issuing government’s ability to print money but emphasize the severe inflationary and currency devaluation risks associated with doing so without corresponding real economic output [7].

Conversely, mainstream economists and fiscal conservatives, supported by research from institutions like the Congressional Budget Office (CBO) [2], Brookings Institution [3], and the Peter G. Peterson Foundation [4], see the escalating debt as a significant long-term threat. These analyses consistently project that without policy changes, deficits will remain unsustainably high, leading to increased interest costs that consume a growing share of the federal budget.

The Impact If Nothing Is Done

If the trends highlighted in “USA, Inc. 2025” remain unaddressed, the potential economic ramifications could be severe and far-reaching:

- Increased Taxes and/or Reduced Public Services: To service the growing debt, the government would eventually face difficult choices: raise taxes, cut spending on essential public services (like education, infrastructure, or defense), or a combination of both [5, 9].

- Crowding Out of Private Investment: As the government borrows more, it competes with the private sector for available capital. This can drive up interest rates for businesses and consumers, making it more expensive for companies to invest and expand, ultimately stifling innovation and economic growth [5].

- Stagflation Risk: An uncontrolled increase in the money supply to finance deficits, coupled with supply-side constraints, could lead to stagflation—a damaging combination of stagnant economic growth, high unemployment, and rising inflation [8].

- Devaluation of the Dollar: Sustained large deficits and a perceived inability to manage debt could erode international confidence in the U.S. dollar. This could lead to a devaluation of the currency, making imports more expensive, reducing purchasing power for Americans, and potentially undermining the dollar’s status as the world’s reserve currency [9].

- Reduced Fiscal Flexibility: A high debt burden leaves the government with less capacity to respond to future crises (e.g., pandemics, natural disasters, economic recessions) without further destabilizing its finances [2, 5].

The Importance of Government Financial Literacy

The underlying message of “USA, Inc.” – both the 2011 and 2025 versions – transcends partisan economics: government financial literacy is paramount. For citizens to make informed decisions and hold their elected officials accountable, a basic understanding of the nation’s financial statements is crucial. Meeker’s report, while crafted with an investor’s precision, is seemingly intended for a broad audience, distilling complex financial data into digestible charts and narratives.

Paradoxically, while the report aims for public comprehension, its detailed nature means it will likely be consumed and debated most rigorously by researchers, academics, economists, and financial industry professionals. Yet, those who will be most profoundly impacted by the underlying fiscal events – average citizens whose future taxes, public services, and economic opportunities are at stake – may be the least likely to fully engage with or understand the nuances of the document. This highlights a critical challenge: translating complex fiscal realities into actionable insights for the very public it seeks to inform. While there maybe disagreement over the impact, the trends and path are troubling and we hope that all Americans make informed choices regarding America’s future.

Citations:

[1] Meeker, Mary, & Krey, A. (2025, March). USA Inc. Revisited (Mar 2025). Bondcap. https://www.bondcap.com/report/pdf/USA_Inc_Revisited.pdf

[2] Congressional Budget Office. (2025, March 27). The Long-Term Budget Outlook: 2025 to 2055. https://www.cbo.gov/publication/61270

[3] Wessel, D. (2025, May 19). The Hutchins Center’s David Wessel gives his perspective on America’s national debt. Brookings Institution. https://www.npr.org/2025/05/19/nx-s1-5402831/the-hutchins-centers-david-wessel-gives-his-perspective-on-americas-national-debt

[4] Peter G. Peterson Foundation. (2025, April 15). Fiscal Outlook. https://www.pgpf.org/issues/fiscal-outlook/

[5] Bipartisan Policy Center. (2025, April 16). Why the National Debt Matters for the U.S. Bond Market and and the Economy. https://bipartisanpolicy.org/explainer/why-the-national-debt-matters-for-the-u-s-bond-market-and-the-economy/

[6] Wikipedia. Modern Monetary Theory. Retrieved May 21, 2025, from https://en.wikipedia.org/wiki/Modern_monetary_theory

[7] Mankiw, N. G. (2020). A Skeptic’s Guide to Modern Monetary Theory. NBER Working Paper No. 26650. National Bureau of Economic Research. https://www.nber.org/papers/w26650

[8] EBSCO Research Starters. Stagflation. Retrieved May 21, 2025, from https://www.ebsco.com/research-starters/economics/stagflation

[9] Corporate Finance Institute. Devaluation. Retrieved May 21, 2025, from https://corporatefinanceinstitute.com/resources/economics/devaluation/

[10] Business Insider. Retrieved 15 March 2019. “A new survey shows that zero top US economists agreed with the basic principles of an economic theory supported by Alexandria Ocasio-Cortez”.