A downgrade of US Creditworthiness

The recent downgrade of the United States government’s long-term issuer and senior unsecured ratings by Moody’s Investors Service to Aa1 from Aaa has reignited discussions about the nation’s fiscal health. This action places Moody’s rating in line with those of the other two major credit rating agencies, Fitch Ratings and Standard & Poor’s (S&P), both of which had previously lowered their assessments of U.S. creditworthiness. While the immediate market reaction has been relatively muted, this sequential decline in ratings warrants a closer examination of its meaning, causes, and potential ramifications for the U.S. and the global economy.

The Role of Credit Rating Agencies

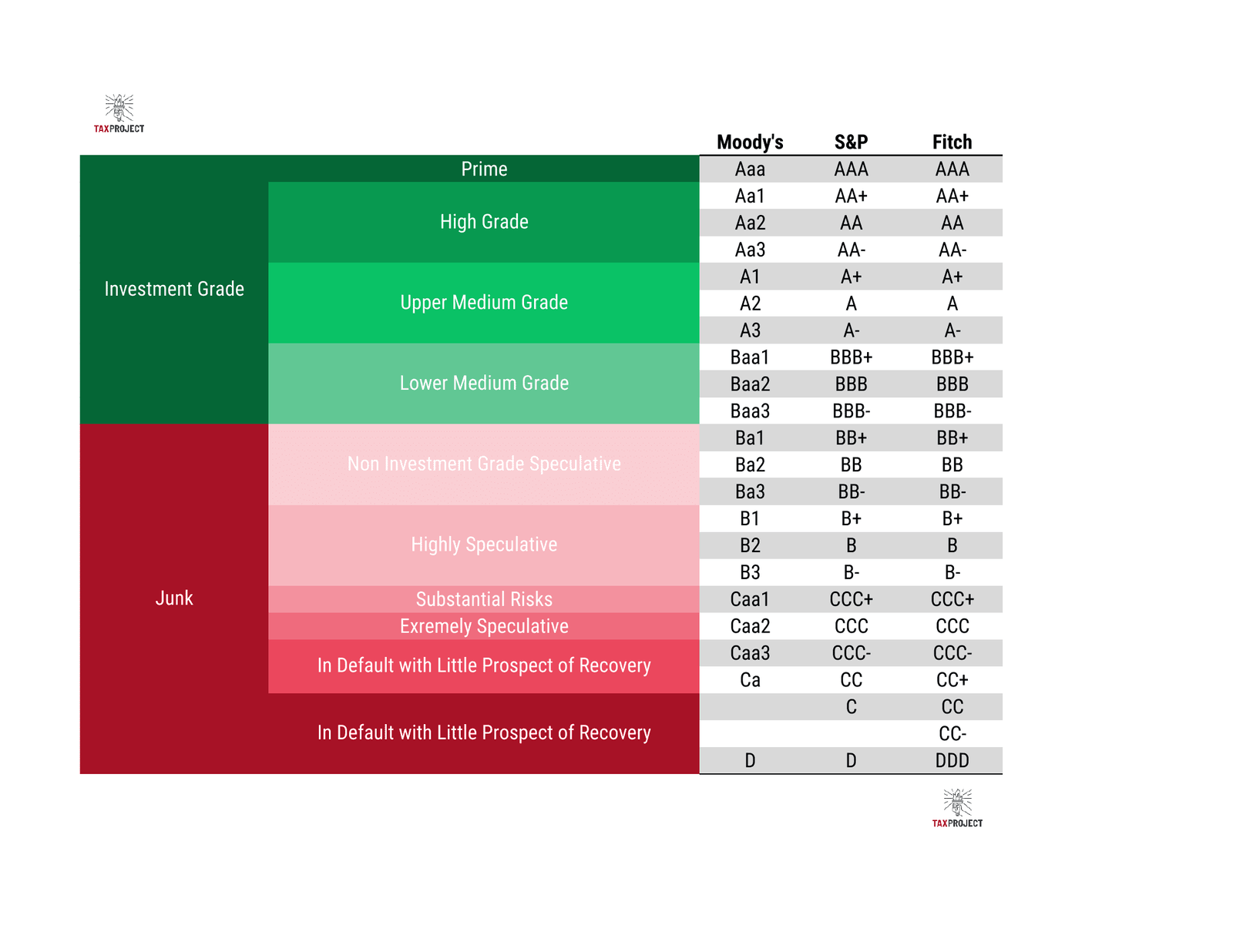

Credit rating agencies, including Moody’s, Fitch, and S&P, play a crucial role in the financial system. Designated as Nationally Recognized Statistical Rating Organizations (NRSROs) by the U.S. Securities and Exchange Commission (SEC), these agencies provide independent assessments of the creditworthiness of borrowers, including sovereign nations, corporations, and municipalities. Their ratings, which range from the highest (e.g., AAA or Aaa) to the lowest (indicating default), are used by investors worldwide to gauge the level of risk associated with lending to these entities. These ratings influence borrowing costs and investor confidence, thereby impacting capital flows and overall economic stability.

Understanding a Downgrade

A downgrade in a sovereign credit rating signifies the agency’s opinion that the borrower’s ability to meet its financial obligations has weakened. This can stem from various factors, including a deteriorating fiscal outlook, rising debt levels, political instability, or a weakening economy. While not a prediction of imminent default, a downgrade serves as a warning sign, prompting investors to reassess the risk associated with holding that country’s debt.

Reasons for the Downgrade

Moody’s rationale for the recent downgrade centered on the “increase over more than a decade in government debt and interest payment ratios.” The agency highlighted the “successive governments’ failure to address rising deficits and interest costs” and expressed concerns about the expectation of “federal deficits to remain very large, weakening debt affordability.” This aligns with long-standing concerns about the trajectory of U.S. fiscal policy.

The Moody’s downgrade follows earlier actions by Fitch and S&P. S&P was the first of the three to lower the U.S. rating, downgrading it to AA+ in August 2011. This decision was largely driven by concerns over political gridlock during a debt ceiling crisis and the lack of a credible long-term plan to address the nation’s rising debt burden. More recently, in August 2023, Fitch also downgraded the U.S. to AA+, citing similar concerns about the growing national debt, political polarization, and the erosion of governance.

The fact that all three major rating agencies now place the U.S. sovereign credit rating one notch below the coveted AAA/Aaa status underscores a consistent theme of concern regarding the nation’s fiscal management. While the specific timing and emphasis of each agency’s rationale differed, the underlying worry about the sustainability of U.S. debt is a common thread. While credit rating changes can occur, they are not frequent, and these downgrades are noteworthy.

The US has been running a Fiscal Deficit, meaning that the annual Revenue has been less than the annual Spend for 24 years. 2001 was the last year the US ran a Fiscal Surplus, since then every year we have spent more than we raised in public funds with recent years budgets with Fiscal Deficits in the trillions.

Why the Downgrade Matters

The downgrade of the U.S. credit rating carries several important implications:

- Increased Borrowing Costs: As the perceived risk of lending to the U.S. rises, investors may demand a higher yield on Treasury bonds to compensate. Higher interest rates on U.S. debt increase debt service payments, straining the federal budget.

- Reduced Investor Confidence: A downgrade can erode investor confidence in the U.S. economy, potentially leading to decreased domestic and foreign investment.

- Potential Impact on the Dollar: A lower credit rating could put downward pressure on the value of the U.S. dollar. If other countries reduce their holdings of dollar-denominated assets in their reserves, or if there’s a perception that the U.S. might devalue the dollar to ease its debt burden, this could weaken the currency.

- Long-Term Fiscal Challenges: The downgrades highlight the long-term challenges posed by the growing national debt and rising debt service costs, potentially limiting the government’s ability to respond to future economic shocks or invest in critical areas.

Broader Macroeconomic Context

Beyond the immediate impact on borrowing costs, a downgrade can also have broader implications for investor confidence. U.S. Treasury bonds are a benchmark for global finance, and their perceived safety underpins much of the international financial system. A lower rating, even if only by one notch, can subtly erode this perception of safety, potentially leading some investors to re-evaluate their asset allocations.

The U.S. dollar’s status as the world’s reserve currency is another factor to consider. This status affords the U.S. significant economic advantages, including lower borrowing costs and greater flexibility in managing its debt. As of the March 2025, foreign holdings of U.S. Treasury securities were approximately $9.05 trillion [2]. While a credit rating downgrade alone is unlikely to dethrone the dollar as the primary reserve currency, persistent fiscal challenges and a continued decline in perceived creditworthiness could, over the long term, chip away at this dominance. Some nations might diversify their holdings into other currencies or assets, impacting the dollar’s value and the U.S.’s ability to finance its debt. A group of countries known as BRIC (Initially from Brazil, Russia, India, and China – now 10 countries) is seeking to provide an alternative to the US Dollar reserve.

Another potential concern arises from the Federal Reserve’s actions. If the Federal Reserve slows its open market sales (i.e., reduces the pace at which it is selling assets from its balance sheet), this could be interpreted as a signal that the central bank is less committed to reducing the money supply and controlling inflation, which are key factors influencing a currency’s value. While the Fed’s actions are driven by a complex set of economic considerations, any perceived hesitation in addressing inflation could further weigh on the dollar.

It’s important to contextualize these downgrades. The U.S. remains the world’s largest economy, with deep and liquid financial markets. The demand for U.S. Treasury bonds remains substantial. The recent downgrades, while significant as indicators of concern, have not triggered a massive sell-off of U.S. debt or a dramatic surge in interest rates. This suggests that while investors acknowledge the fiscal challenges, they still view U.S. debt as a relatively safe asset compared to many other sovereign borrowers.

Source: FRED National Debt

Source: FRED Interest on Debt

Historical Context

While the U.S. has historically enjoyed a very high credit rating for an extended period, these downgrades, while infrequent, are a noteworthy departure from the norm. Just this week Newsweek reported, “Moody’s held a perfect credit rating for the US since 1917” [1], marking over 100 years without a downgrade. It is important to note that evolving rating scales and methodology changes require careful historical analysis of Moody’s records. However, it can’t be taken lightly that a change, even so slight, after 100 years is worthy of attention, and understanding of the significance.

Looking Ahead

Looking ahead, the implications of these downgrades are multifaceted. They serve as a persistent reminder of the need for responsible fiscal management. While no immediate crisis is likely, the continued accumulation of debt and the rising cost of servicing it pose long-term challenges to U.S. economic stability and fiscal flexibility. These downgrades could exert subtle pressure on policymakers to address the underlying fiscal issues, although the political will to enact significant changes remains a key uncertainty.

In conclusion, the Moody’s downgrade, following similar actions by Fitch and S&P, underscores a growing consensus among major rating agencies regarding the challenges facing U.S. fiscal policy. While the immediate impact may be limited, these downgrades serve as important indicators of the need for sustainable fiscal practices to maintain investor confidence, manage borrowing costs, and safeguard the long-term economic health and global standing of the United States. The sequential decline in ratings, driven by concerns about rising debt and ineffective fiscal management, highlights a vulnerability that warrants ongoing attention and responsible policy responses.

References

[1] Newsweek. “US Completely Loses Perfect Credit Rating for First Time in Over a Century.” Newsweek, May 16, 2025, https://www.newsweek.com/moodys-us-credit-rating-negative-2073510.

[2] Reuters. “Foreign holdings of US Treasuries top $9 trillion in March, data shows” Reuters, May 16, 2025, https://www.reuters.com/markets/us/foreign-holdings-us-treasuries-top-9-trillion-march-data-shows-2025-05-16/