Fiscal Dominance Explained

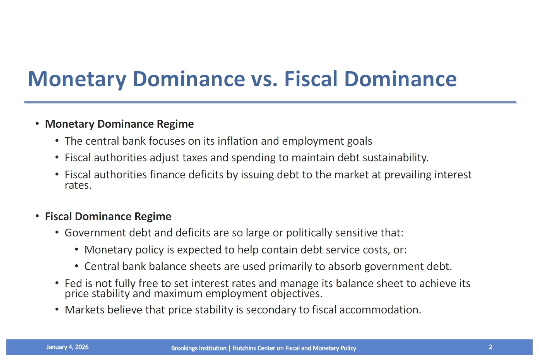

In a healthy Economic environment the Central Bank of a country, the Federal Reserve (Fed) in the United States, manages the Monetary Policy that manages the money supply, and sets interest rates to keep inflation under control and the job market healthy. The Federal Reserve is said to have a dual mandate to maintain stable pricing (manage Inflation), and maximum employment (stable Jobs). While elected officials in the Executive Branch and Congress manage the Fiscal Policy that sets taxes and the budget that determines spending. These functions are setup as independent processes with different goals.

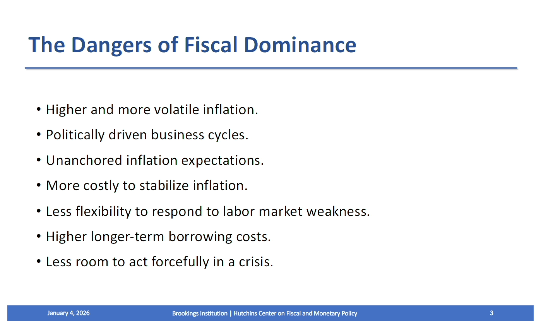

Fiscal Dominance is a term used when a Country’s Debt and Deficits get so large that Fiscal Policy begins to, either explicitly or implicitly, steer Monetary Policy. This can be a very troublesome situation to be in because it puts two competing responsibilities into conflict at times, and in general should be avoided where possible because of the risks involved. In high debt environments, interest payments on the debt can become very large and begin to crowd out other Government spending. As the interest rates raise, the debt payments grow and compound the challenges. This can put pressure on the Fed to go against their mandate to lower interest rates and thereby reduce the cost of the debt service payments. However, by lowering rates the Fed may lose control on Inflation which may rise higher than their target rate.

Former Treasury Secretary and Federal Reserve Chair Janet Yellen defines it as when deficits and debt put so much pressure on the government’s financing needs that Monetary Policy becomes “subordinate” to those needs, meaning the central bank is pushed to keep rates “lower than warranted” or buy government debt “to ease the government’s financing burden.” [1]

The challenge is that inflation becomes the easiest way out because it can immediately reduce the cost of debt service and quietly shrink the real value of what the Government owes. This is a lot easier for elected officials than raising taxes, cutting spending, or changing entitlement programs due to the unpopularity with constituents. However, through inflation it also shrinks the buying power of everyone’s dollars.

“If congress is unable or unwilling to address primary deficits the problems will compound and the temptation to rely on inflation or financial repression to reduce the debt burden will surely grow.”

Janet Yellen , “The Future of the Fed” January 4-5, 2026 [1]

Why does it Matter?

Since the COVID pandemic, after a long period of stable pricing, the US experienced higher than normal inflation, and most Americans now understand inflation, and what is being called the “Affordability Crisis” as something much more tangible and real. Inflation is no longer an abstract statistic. It is the slow (or sometimes fast) loss of what your money can buy. The Bureau of Labor Statistics tracks prices with the Consumer Price Index and explains inflation as when prices rise, the purchasing power of the dollar declines. [4]

The damage caused by inflation shows up everywhere: groceries, gas, rent, insurance, childcare, car repairs. If pay does not keep up with inflation then living standards slip. If you hold cash or earn a low interest rate on savings, inflation reduces the value of your money punishing savers, those on fixed income, and the most vulnerable.

You can also see inflation worry show up in markets. When people get uneasy about the future buying power of dollars, they often look for hedges. Gold is the classic example. Recently Gold has been hitting record highs above $5,000/oz in late January 2026, driven by safe-haven demand and uncertainty, along with expectations about interest rates and heavy Federal Reserve buying. [3]

None of this is to say Fiscal dominance is happening now, but as Janet Yellen recently said “the preconditions…are clearly strengthening.” (See Janet Yellen Statements here)

“the preconditions for fiscal dominance are clearly strengthening”

Janet Yellen, “The Future of the Fed” January 4-5, 2026 [1]

“I doubt Americans will wind up on the Fiscal Dominance course, but I definitely think the dangers are real and should be monitored.”

Janet Yellen , “The Future of the Fed” January 4-5, 2026 [1]

Why is this Dangerous?

The risks are not about political parties, or politicians, but basic math. Here are some of the challenges:

When Debt is High, Interest Increases Hurt!

When the government owes a lot, even modest levels of debt can become expensive with high interest rates. That expense to pay the rising interest cost on debt competes with everything else the government wants to do. For every 1% increase in interest rates debt service costs increase nearly $400 billion annually. [6] (See Table 1 below)

The Congressional Budget Office’s (CBO) February 2026 outlook (summarized by the Committee for a Responsible Federal Budget) shows debt held by the public around 100% of GDP (i.e. the entire US Economy) and projected to rise to about 120% by 2036. It also shows Net Interest costs (the amount we pay on debt) more than doubling from ~$970 billion in 2025 to about ~$2.1 trillion by 2036, rising from about 3.2% of GDP to about 4.6% of GDP. [2]

High Interest Costs Squeeze Budgets

Unlike many budget expenses, interest is the part you pay because of past spending. It does not build roads, improve schools, or provide services directly. As it grows, it can crowd out other priorities or force harder choices later.

The current Net Interest is larger than the expense of the US Military, so doubling that cost would be a very large expense putting pressure on other spending. Whether someone sees those numbers as “manageable” or “dangerous,” they are big enough to create strong political pressure around interest rates.

This is where Fiscal Dominance risk starts to become realistic: if interest costs feel like they are exploding, it becomes politically tempting to push for lower rates regardless of inflation conditions.

The Catch-22: Debt Service vs Inflation

For younger folks a Catch-22 is a situation with no good options. You’re dammed if you do, and dammed if you don’t.

Here is the doom loop in simple steps:

- Inflation is too high, or the risk of inflation is rising.

- The Fed raises rates to slow inflation and protect the value of the dollar.

- Higher rates raise the government’s interest bill over time.

- The higher interest rate increases debt service cost that squeezes the budget.

- Pressure rises to lower rates to “stop the bleeding” and lower interest costs.

- If rates are cut too soon, inflation can come back, and the cycle repeats.

Yellen’s warning is that when the central bank is constrained from raising rates because it would increase debt service or cause fiscal stress, inflation expectations can become “unanchored,” and people may start to think inflation is the “path of least resistance” for managing high debts. [1]

That phrase is worth translating: once a society starts to believe “they will inflate rather than make hard choices,” the value of money becomes a political variable. That is when inflation becomes harder to control.

| Interest rate | Estimated Net Interest | Delta vs Current |

|---|---|---|

| 1% | $0.39T | -$0.93T |

| 2% | $0.77T | -$0.54T |

| 3% | $1.16T | -$0.15T |

| Current (3.4%) | $1.31T | $0.00T |

| 4% | $1.55T | +$0.23T |

| 5% | $1.93T | +$0.62T |

| 10% | $3.86T | +$2.55T |

| 15% | $5.80T | +$4.48T |

| 20% | $7.73T | +$6.42T |

Can Both Sides be Right and Wrong?

It can be hard in our polarized environment not to think about this as either one side is Right or Wrong, however that misses the point. Both Fiscal and Monetary policy play important roles in the Economy and impact all Americans. Normally these can operate independently and support each other, a sort of Yin and Yang that balance each other out. The challenge when Debt and Spending get so large that they put Monetary and Fiscal responsibilities into conflict.

Fiscal Policy: Executive Branch and Congress

What they care about: Spending (Debt service) and Growth

Why they can be Right:

- Lower Interest costs can reduce Net Interest expenses that crowd out other spending and make the budget fragile.

- Lower rates can support growth that can expand the tax base and reduce immediate fiscal strain.

Why they can be Wrong:

- By leaning on the Fed to lower Interest rates they may increase inflation and reduce the value of the dollar.

Monetary Policy: The Federal Reserve

What the Fed cares about: Stable Pricing (Inflation) and Maximum Employment (Jobs)

Why the Fed is Right:

- Protecting purchasing power is not a luxury. When inflation is unstable, everyone lives with more uncertainty, borrowing costs and the Affordability crisis increase, and the value of the dollar diminishes.

- Yellen makes the key point that “stabilizing prices becomes significantly more costly” once inflation expectations take hold. [1]

Why the Fed can be Wrong:

- Tightening policy in a high-debt environment can create political backlash and institutional stress. Even if the Fed’s policy is “correct” on inflation, it can still trigger a fight over Fed independence that changes the rules of the game.

- Short term priorities due to massively rising Debt Service costs may pose greater danger than long term rising inflation.

This is the core Catch-22: the fiscal side is not crazy to care about interest costs, and the Fed is not crazy to prioritize inflation. Inflation can be a lot like a heart attack, it can go quietly unnoticed but suddenly impact you. By letting inflation slowly (or quickly) devalue the dollar, everything gets more expensive and your savings are worth less.

What does Fiscal Dominance look like?

Fiscal dominance usually does not arrive with a press release. It shows up as a drift in behavior and expectations, such as:

- Repeated pressure to cut rates mainly to reduce the government’s borrowing costs.

- A growing expectation that the central bank will not do what it takes to control inflation if it would make the budget painful.

- Challenges to the Federal Reserve autonomy

- Investors demand compensation to cover the additional Risk Premia because they worry the government will rely on inflation to manage the debt, devaluing the dollar.

Yellen’s Listed Preconditions

- Steep upward debt trajectory: CBO projects debt rising from ~100% of GDP in 2026 to over 150% in three decades—current levels already test sustainability.

- Persistent large deficits: ~6% of GDP overall (~3% primary), unprecedented outside wars/recessions, with no credible medium-term fiscal adjustment plan from either party.

- Debt service pressure on monetary policy: When debt hits ~120%+ GDP, rate hikes to fight inflation risk exploding interest costs, forcing Fed to prioritize debt financing over its dual mandate.

Yellen flags the same idea: fiscal dominance can raise borrowing costs if investors become concerned the government will rely on “inflation or financial repression” to manage debt. [1]

“Kick the can down the Road”

Many Western Democracies are trapped in a similar situation: High Debt, Growing Entitlements, Limited will to Raise Taxes or Cut Spending. It is politically far easier to postpone painful choices. Nobody wants higher taxes. Nobody wants spending cuts. Nobody wants entitlement changes. That political reality is not a moral failing; it is a constraint.

However, the longer we stay on our current fiscal path and our debt continues to grow, the more painful the eventual adjustment will be. This is not a problem that goes away on its own. Yellen states the hard version of this idea: if markets do not expect future budget surpluses to cover the debt, “the adjustment eventually comes via inflation or default.” [1]

For the U.S., “default” is not the scenario most people think about, although all three rating agencies have downgraded the US [5]. The more realistic concern is a mix of:

- Higher Inflation – everything will cost more, and your money will be worth less

- Higher Borrowing Costs – credit will cost more

- Forced Fiscal Changes – some combination of tax increases and/or spending cuts

This is why Fiscal Dominance is not just a “Fed independence” topic. It is about whether the country chooses a gradual planned path or dramatic unplanned (but predictable) one. (See our Article: Ways out of Debt)

Summary

Fiscal Dominance is not a slogan and it is not “here” yet. It is a risk that grows when debt is high, and interest costs are large, and political incentives push for easier money even when inflation is not truly under control. The stakes are high, we can begin to manage it now, or we risk higher inflation and the devaluation of the dollar and the cost of everything increasing.

Citation

[1] Janet Yellen, “Remarks on the future of the Fed: Central bank independence and fiscal dominance” (Brookings, Jan 2026). (Brookings)

[2] CBO February 2026 outlook summary (Committee for a Responsible Federal Budget, Feb 11, 2026). (CRFB)

[3] “Gold jumps over 3% to record peak…” (Reuters, Jan 27, 2026). (Reuters)

[4] BLS CPI FAQ and purchasing power notes (BLS). (Bureau of Labor Statistics)

[5] CNN. May 2025. “The United States just lost its last perfect credit rating.” (CNN)

[6] Based on US Treasury Debt to Penny 2/12/26, average rate on interest-bearing debt 12/4/25 Peterson Foundation