Civic Responsibility

Government Financial Literacy (GFL) is emerging as an essential pillar of civic knowledge in the 21st century. As citizens encounter increasingly complex public budgets, policies, and economic challenges, understanding how government finances work is key to informed participation in democracy. But what exactly does government financial literacy mean, and why is it so important? This explainer breaks down the concept, its core components, and its impact on individuals and society.

Defining Government Financial Literacy

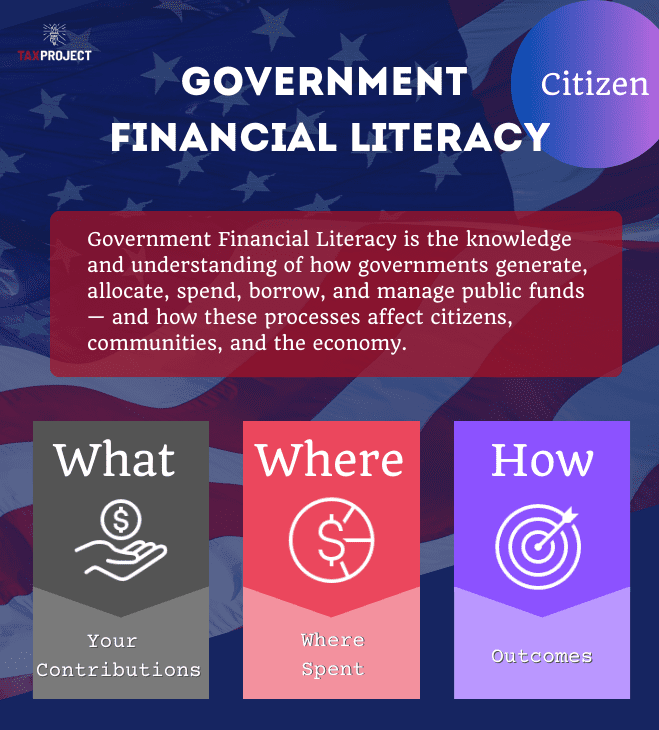

At its core, government financial literacy is the knowledge and understanding of how governments generate, allocate, spend, borrow, and manage public funds-and how these processes affect citizens, communities, and the economy. It encompasses the ability to interpret government budgets, understand sources of public revenue, evaluate spending priorities, and assess the implications of public debt and fiscal policy.

This form of literacy expands upon personal finance concepts. It equips individuals to analyze decisions made by local, state, and federal governments, and to recognize how these choices impact public services, economic, and household well-being.

“Democracy cannot succeed unless those who express their choice are prepared to choose wisely. The real safeguard of democracy, therefore, is education.”

Franklin D. Roosevelt

What, Where, and How

Government financial literacy allows you to understand the actions and events that take place in our government that effect your household, community, and country. It arms you with the knowledge to understand:

- What: What you contribute to our country in the form of taxes, and government revenue.

- Where: Where our government allocates, and spends revenue.

- How: How efficiently, and effectively are public funds spent, and what are the outcomes.

Key Components of Government Financial Literacy

Government financial literacy spans a wide array of topics, each critical for understanding the full picture of public finance. The following taxonomy, drawn from leading educational infographics and national strategies, outlines its main elements:

1. Revenue: Where Government Money Comes From

- Taxes: Understanding the composition and sources of taxes-income, sales, property, and others-at all levels of government.

- Fees, Fines, and Licenses: Recognizing additional revenue streams such as service fees, penalties, and licensing charges.

- Federal and State Transfers: Grasping how funds flow between different levels of government.

- Public Income: Awareness of government-operated enterprises like utilities that generate revenue.

2. Spending: How Public Funds Are Used

- Spending Composition: Distinguishing between discretionary and mandatory spending, and between federal, state, and local expenditures.

- Outlays and Obligations: Understanding government commitments, including contracts, grants, leases, and entitlements.

- Vendors and Recipients: Knowing who receives government funds and for what purposes.

3. Budget and Appropriation Process

- Legislative and Executive Functions: Learning how budgets are proposed, debated, and enacted.

- Deficits vs. Surpluses: Understanding the difference and implications of spending more or less than revenue.

- Fiscal Policy: Recognizing how government uses taxation and spending to influence the economy.

4. Debt: Borrowing and Its Consequences

- Debt Mechanics: How and why governments borrow money.

- Impact of Debt: Assessing the effects of public debt on economic stability and future budgets.

- Sustainability: Evaluating whether current fiscal practices can be maintained over time.

5. Monetary Policy and Currency

- Monetary Policy: Understanding how central banks manage money supply and interest rates.

- Reserve Currency: Recognizing the role of national currencies in global finance.

6. Transparency and Accountability

- Audits and Reporting: Knowing how government finances are monitored and disclosed.

- Citizen Tools: Accessing public data and using watchdog resources.

- Open Government: Ensuring transparency to prevent fraud, waste, and abuse.

7. Outcomes and Public Services

- Quality and Service Levels: Evaluating the effectiveness of government spending on public services.

- Economic Growth and Household Economics: Understanding the broader impact of government finance on the economy and individual households.

- Efficiency and Fiscal Responsibility: Promoting the prudent and effective use of public resources.

Why Government Financial Literacy Matters

A financially literate public is empowered to:

- Evaluate Government Performance: Citizens can assess whether their government is managing resources wisely and delivering results.

- Hold Government Accountable: Knowledgeable voters and taxpayers can demand transparency and responsible stewardship of public funds.

- Encourage Civic Participation: Informed individuals are more likely to engage in voting, advocacy, and community decision-making.

- Advocate for Fairness: Communities can push for equitable distribution of resources and services.

- Build Trust: Transparency and accountability foster public confidence in government institutions.

- Informed Decisions: Better choices lead to better outcomes, for our household, community, and country.

As highlighted by the U.S. National Strategy for Financial Literacy, improving financial literacy at all levels enhances the ability of citizens to make informed choices, strengthens democracy, and supports a healthy, prosperous society1.

Conclusion

Government financial literacy is not just a specialized skill for policymakers or accountants-it is a key competency for every citizen. By understanding how our government manages the publics financial affairs, including generating revenue, spending, managing debt, and delivering services – individuals are better equipped to participate in civic life, advocate for their communities, and contribute to a more transparent and effective democracy. By improving upon the collective input of all Americans the many small decisions we make about our country can benefit all of us in our communities, households, and country.

Reference:

- US Financial Literacy and Education Commission (FLEC) https://home.treasury.gov/system/files/136/US-National-Strategy-Financial-Literacy-2020.pdf

- https://www.nefe.org/news/2021/08/review-of-the-u.s.-national-strategy-for-financial-literacy.aspx

- https://www.nefe.org/news/2023/03/new-advocacy-resource-infographics-on-financial-educations-effectiveness.aspx

- https://www.occ.gov/topics/consumers-and-communities/community-affairs/resource-directories/financial-literacy/index-financial-literacy-resource-directory.html

- https://www.visualcapitalist.com/americas-growing-financial-literacy-problem/

- https://everfi.com/infographic/financial-education/fined-mandates-infographic/