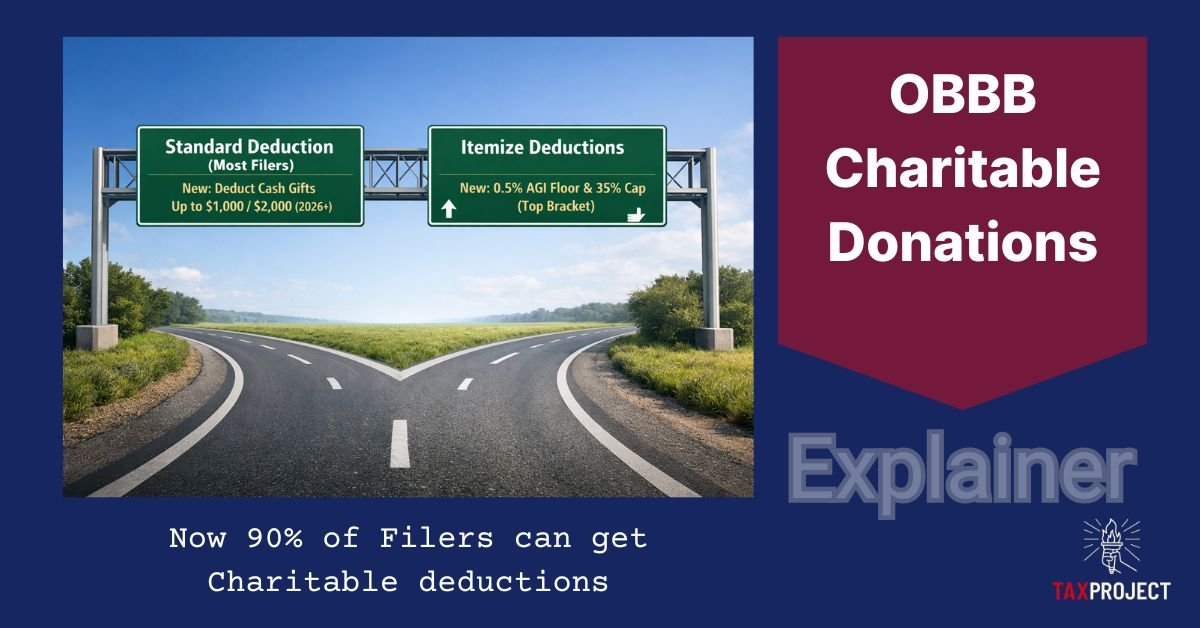

Good news for those who donate*: starting in tax year 2026, the One Big Beautiful Bill Act (OBBB, also seen as OBBBA) changes the federal tax rules around charitable giving in a way that makes a charitable deduction available to many more taxpayers than before. This explainer summarizes what changed, who benefits, what got harder for itemizers, and why charitable giving (money and time) still matters at a national scale. [1][2][3]

What is the OBBB, and what changed?

The One Big Beautiful Bill Act (OBBB) is a major federal law enacted in 2025 with major changes to the Tax Code including several provisions affecting charitable giving apply starting tax year 2026. [1][2]

The key changes for Charitable Donations:

- Before (through 2025): If you took the standard deduction, you generally could not deduct charitable donations on your federal return.

- After (starting 2026): Many standard deduction filers can deduct a limited amount of qualifying charitable giving, while itemizers face new thresholds that can make some giving less deductible than before. [3][4]

Who can donate?

So what is the big deal, many people donate right? True, but the catch was that only taxpayers who itemized deductions generally received a federal tax deduction for charitable gifts.

However, most taxpayers do not itemize. IRS Statistics of Income data for tax year 2022 shows 88.6% of returns claimed the standard deduction. [5] In plain terms: roughly 9 out of 10 filers were typically not eligible for a charitable deduction simply because they didn’t itemize, even if they donated. This is even bigger because while many people donate across all income levels, generally only higher income individuals with more itemized deductions used the itemize form, and therefore almost 90% of filers who could most use the deduction were left out.

The Good news – that all changes with OBBB: starting in 2026, you don’t need to be a wealthy itemizer to get a deduction, standard deduction filers can now deduct some charitable giving again (within limits and rules). [3]

Pre vs Post OBBB: Donation Rules Changes

| Topic | Pre-OBBB (baseline, through 2025) | Post-OBBB (starts 2026) |

|---|---|---|

| Standard deduction filers (non-itemizers) | Usually no federal deduction for charitable donations if you don’t itemize | New non-itemizer charitable deduction for cash gifts: up to $1,000 (single) or $2,000 (married filing jointly); some contributions (such as to certain vehicles like donor-advised funds) are excluded from this specific deduction [3] |

| Itemizers – when deductions start counting | Charitable deductions generally counted from the first dollar (subject to normal rules) | New 0.5% of AGI floor: itemizers generally only deduct contributions above 0.5% of AGI [4] |

| High-income itemizers (top bracket) | Benefit generally tracks marginal tax rate (subject to normal limits) | Tax value of itemized charitable deductions capped at 35% for top-bracket filers (slightly reduces the marginal tax value vs a 37% bracket) [3][4] |

What this means (simply)

Good news for Standard deduction filers (~90% of Americans)

Because most filers take the standard deduction (88.6% in TY2022), the new rule expands the ability to get a federal tax benefit for charitable giving to the mainstream filing path. [5]

This does not mean everyone will claim it, or that every gift qualifies. But it does mean millions more households can get at least some tax recognition for giving without itemizing. [3]

A Slight Hurdle for Itemized deduction filers

If you itemize, the new 0.5% of Adjusted Gross Income (AGI) floor means a portion of charitable giving may be treated as not deductible for federal income tax purposes, because only gifts above the threshold count. [4]

A modest change for Top-bracket donors

For filers in the highest Income Tax bracket, the maximum tax value of charitable deductions is capped at 35%. Practically, that can slightly reduce the tax savings associated with a deductible gift for those taxpayers. [3][4]

Quick working examples (easy math)

Example A: Standard deduction filer (single), cash gifts

- You take the standard deduction.

- You donate $600 cash to a qualifying charity in 2026.

Result: You can deduct $600 (because it’s under the $1,000 cap), assuming the gift qualifies under the new rules. [3]

If you donate $1,500, the deductible amount under this rule is generally $1,000 (the cap). [3]

Example B: Itemizer with the new floor

- You itemize.

- Your AGI is $200,000.

- You donate $2,000.

0.5% of AGI = $200,000 x 0.005 = $1,000.

Deductible amount = $2,000 – $1,000 = $1,000. [4]

Giving in America Matters!

Americans give a lot (money + time) to charity – A LOT! We are a Nation of people that care, and want to help put our best foot forward. In total, Americans contribute over $700 Billion in annual charity value. To put that in perspective, there are less than 25 countries whose entire economies are bigger than that, and that is JUST for charity. [8]

- Money: U.S. charitable giving totaled $592.5 billion in 2024 (Giving USA). [6]

- Time: About 60.7 million adults volunteered, contributing 4.1 billion hours, with an estimated economic value around $122.9 billion (standardized valuation approach). [7]

The Charitable giving tax rule changes are a big deal, enabling almost 90% of the population to donate and get something back for it in their taxes. This could open a whole new avenue of both charity, and personal and societal benefits over time giving equal access to the benefits of Charitable contributions to everyone, not just the wealthy.

Bottom line: OBBB shifts how the tax system recognizes giving, and the 2026 update expands access to a charitable deduction for the large group of taxpayers who use the standard deduction. [3][5]

*This is not tax advice, please consult with your tax specialist or accountant to discuss these and any other tax related issues to determine if they are appropriate for your situation.

References

[1] Congress.gov. 2025. “H.R. 1 (119th Congress): Text – Public Law No: 119-21 (07/04/2025).” https://www.congress.gov/bill/119th-congress/house-bill/1/text

[2] Internal Revenue Service (IRS). 2025. “One Big Beautiful Bill Act: Tax deductions for working Americans and seniors.” https://www.irs.gov/newsroom/one-big-beautiful-bill-act-tax-deductions-for-working-americans-and-seniors

[3] Fidelity Charitable. 2025. “One Big Beautiful Bill (OBBB): Impact on charitable giving.” https://www.fidelitycharitable.org/articles/obbb-tax-reform.html

[4] Fidelity. 2025. “3 big changes to charitable giving.” https://www.fidelity.com/learning-center/personal-finance/charitable-giving-tax-changes

[5] Internal Revenue Service (IRS), Statistics of Income. 2024. “Individual Income Tax Returns, Preliminary Data, Tax Year 2022.” https://www.irs.gov/pub/irs-soi/soi-a-inpre-id2401.pdf

[6] Giving USA. 2025. “Giving USA 2025: U.S. charitable giving grew to $592.50 billion in 2024.” https://givingusa.org/giving-usa-2025-u-s-charitable-giving-grew-to-592-50-billion-in-2024-lifted-by-stock-market-gains/

[7] U.S. Census Bureau. 2023. “Volunteering and civic life in America.” https://www.census.gov/library/stories/2023/01/volunteering-and-civic-life-in-america.html

[8] International Monetary Fund (IMF). 2025. World Economic Outlook (WEO) Database (October 2025 Edition): Gross domestic product, current prices (NGDPD), billions of U.S. dollars. Accessed February 6, 2026. https://www.imf.org/external/datamapper/NGDPD@WEO (IMF)