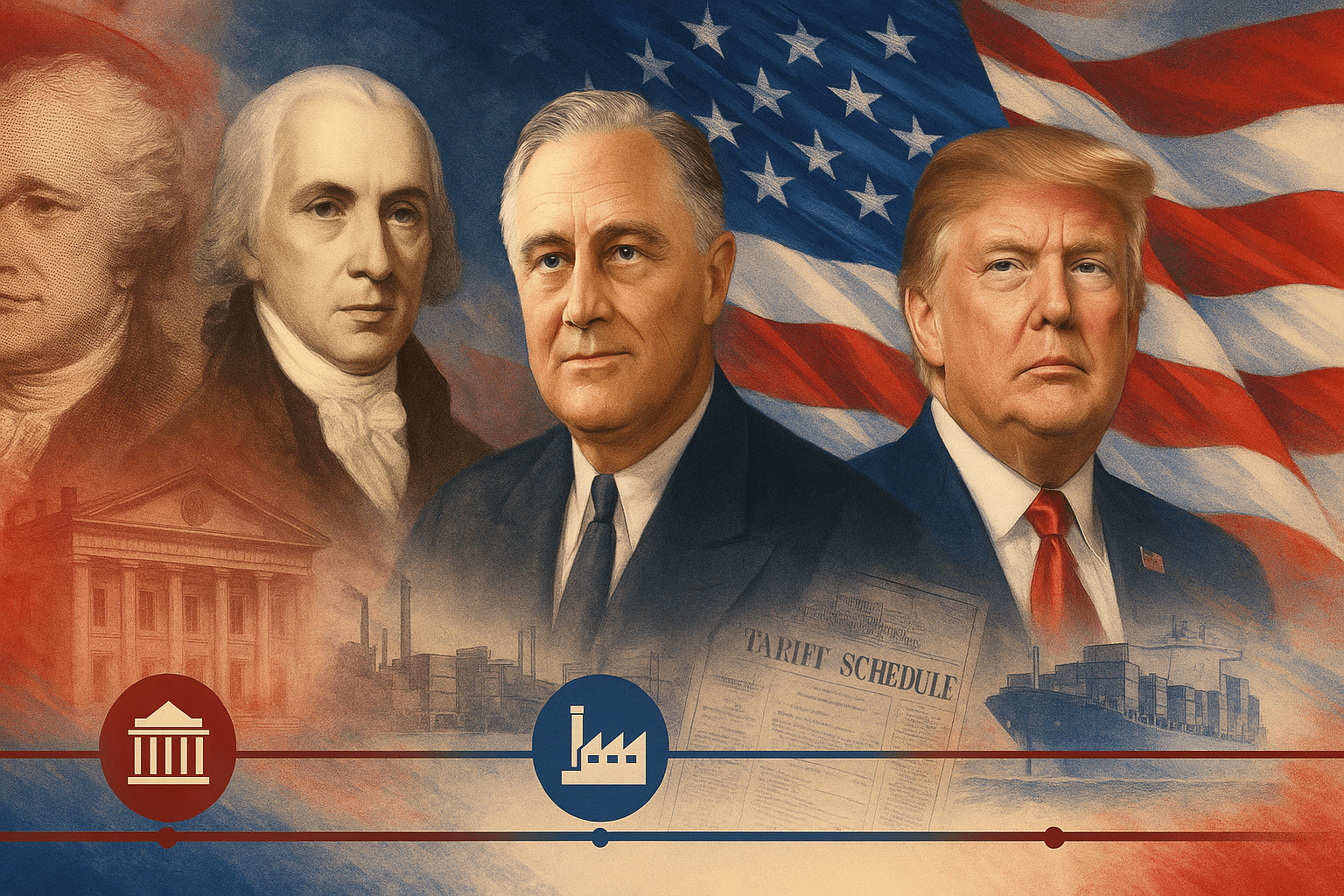

The history of Tariffs is a history of the United States from early trade done by local British and Colonial import/exporters to the uniform standards of the Tariff Act of 1789 introduced by James Madison and advocated and implemented by Alexander Hamilton that became the primary revenue source for the young nation. From Congressional lists and schedules updated every 5-6 years by Congress to the dynamically negotiated agreements done by the Executive branch we have today. From an instrument of revenue to a tool for international trade, geopolitical power, and protection of National interests, Tariffs have been used throughout US History. From the disastrous effects of the Smoot-Hawley act to the triumphs of Post World War II Bretton Woods frameworks leading to our current Global Trade.

- Major source of Revenue for United States

- Establishes Congressional Authority over Tariffs

- First attempt to standardize and provide uniformity to Tariffs across Colonies

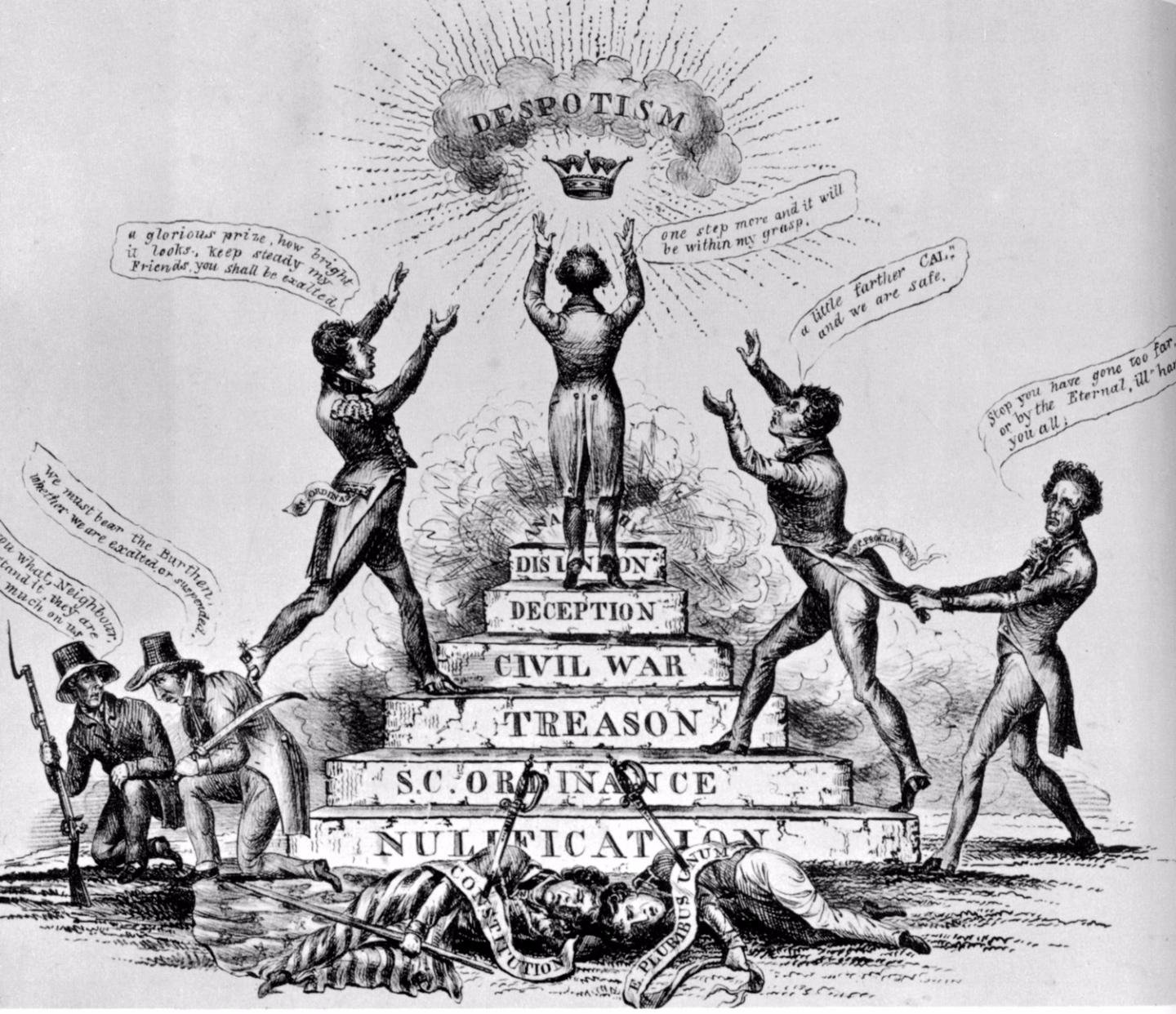

Tariff Act of 1828 – a.k.a. Tariff of Abominations – Protective tariffs aimed at Northern industries cause tensions increasing cost of living in the South, leading to the Nullification Crisis when Vice President John Calhoun anonymously penned the Nullification Doctrine which emphasized a state’s right to reject federal laws within its borders and questioned the constitutionality of taxing imports without the explicit goal of raising revenue. Congress still sets rates but political conflicts highlight tariff complexity.

Significance

- Establishes use of Tariffs as a Protectionism mechanism to protect domestic industry.

- Establishes Congressional Authority over Tariffs

- Created Political tension between the winners and losers of any Tariff policy.

- Some believe set the seeds of Civil War

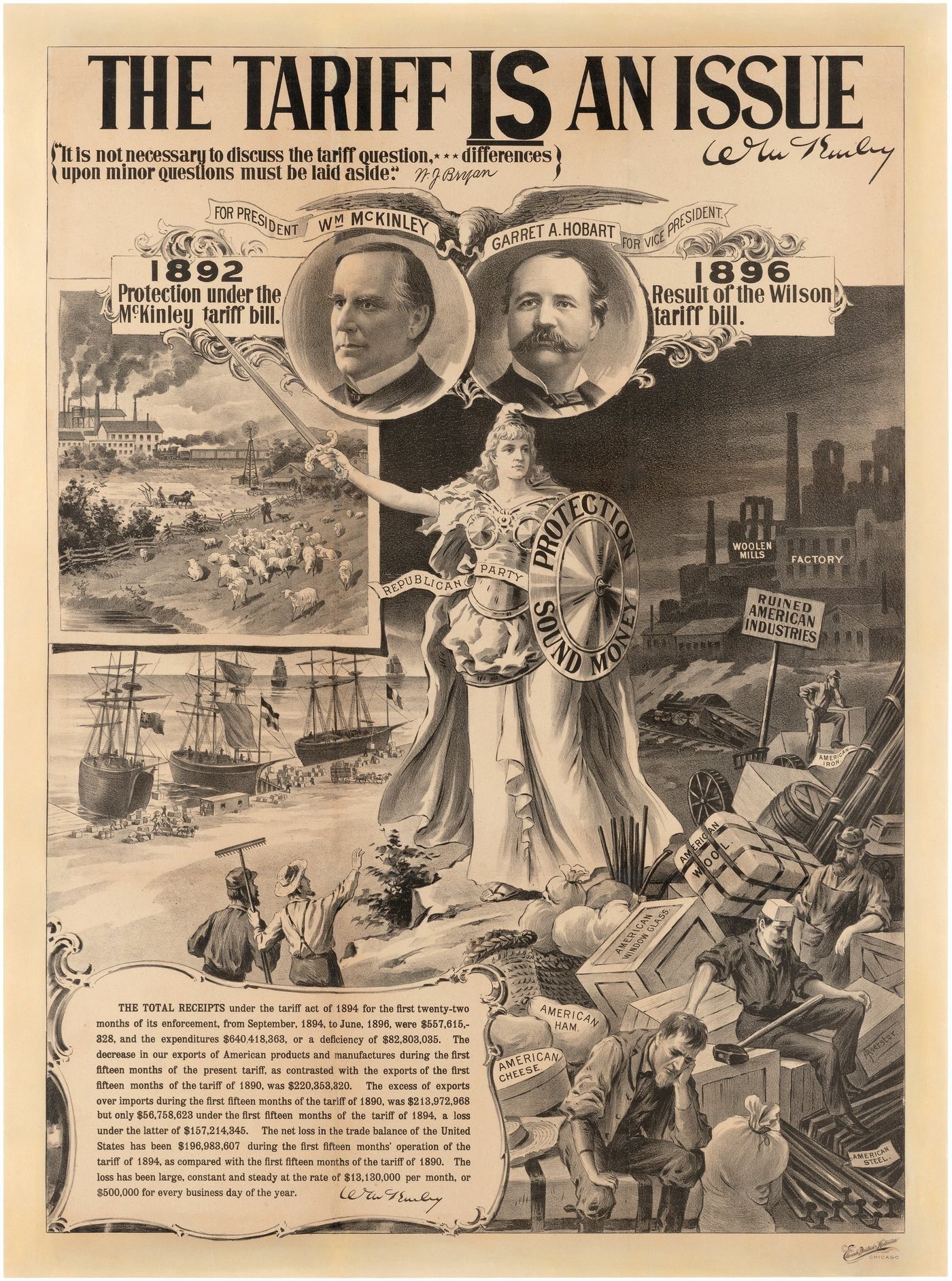

The McKinley Tariff Act of 1890 was a high protective tariff raising rates on many imports. Congress remains central in setting rates, with protectionism as a goal. Introduces role of Executive Branch.

Significance

- Introduced the concept of reciprocity, lowering tariffs if other country lowered theirs

- Introduced role of Executive Branch to manage reciprocity agreements

- Increased Tariff rates to nearly 50%

- Caused sharp increase in Goods

Wilson-Gorman Tariff Act of 1894 attempts reduction of rates on imported goods and introduces a federal income tax. The income tax is struck down by the Supreme Court until it was re introduced after the passage of the 16th Amendment in 1913, reinforcing tariffs role as major revenue in early America.

Significance

- Reduced tariffs on imported goods, reflecting a shift towards lower tariffs

- Introduced the concept of Income taxes to offset lower tariff revenue

- Contributed to the debate on protectionism vs. free trade, impacting economic policy and government revenue sources.

Creation of the U.S. Tariff Commission: A bipartisan body established to advise Congress with expertise, marking increasing professionalization in tariff policy.

Significance

- Predecessor to the US International Trade Commission (USITC)

- Led by Frank Taussig, Harvard Professor

- Created as part of the Revenue Act of 1916 which introduced Income Taxes

- Replaced ad hoc lobby driven policies with analytic and scientific studies and recommendations

Smoot-Hawley Tariff Act – further high tariff rates designed to help farmers exacerbate international trade tensions and the Great Depression. Congressional tariff-setting continues but criticism grows.

Significance

- Started Global Trade War – caused retaliatory tariffs and significantly reduced International trade

- Considered to contribute to worsening the Great Depression

- Global trade levels dropped roughly 2/3rds from 1929 to 1934

Reciprocal Trade Agreements Act (RTAA): Congress delegates authority to the president to negotiate bilateral trade agreements and adjust tariffs within limits dynamically. Beginning of executive role in tariff management.

Significance

- Congressional delegation of bilateral trade agreements to the Executive Branch

- Allowed President to negotiate +/- 50% of existing Smoot-Hawley Tariff rates

- Set Reciprocity as fundamental to negotiating Tariffs that US tariff cuts only if US got a cut in return

- Moved Tariffs from Congressional lists to Executive bargaining

- Unconditional Multi Lateral Most Favored Nation (MFN) clauses – if you cut Tariff X every country gets the best rate – default multi lateral

GATT (General Agreement on Tariffs and Trade) created a post World War II pact that set the rules for non-discriminatory, tariff-based trade among market economies.

Significance

Locked in Most Favored Nation non-discrimination (Article I): any tariff cut for one member extends to all.

Created bound tariff schedules (Article II), making cuts durable and harder to reverse.

Ran multilateral “rounds” that progressively lowered global tariffs.

Established early dispute settlement norms and a rules-based trading system.

Laid the institutional foundation for the World Trade Organization (WTO)

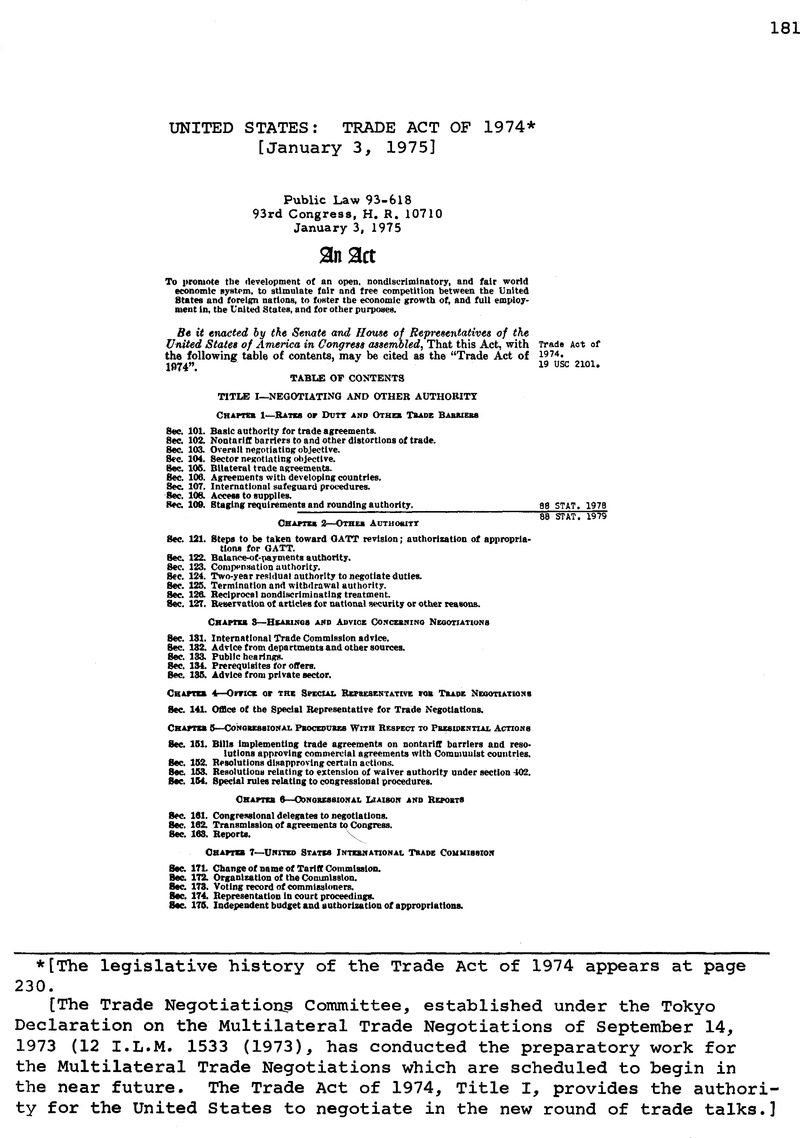

Trade Act of 1974: Expands presidential proclamation powers to modify tariffs without prior congressional approval, reinforcing executive’s flexible role.

Significance

- Expands Presidential role in modifying tariffs without congressional approval

Creates Fast track: Congress sets goals; the President negotiates; Congress takes a simple yes/no vote (no amendments).

Lets the U.S. act against countries that don’t play fair – up to and including new tariffs.

Creates safeguards to provide temporary relief if imports hurt a U.S. industry.

Trade Adjustment Assistance (TAA): Help for workers and firms who lose jobs or business due to imports.

Generalized System of Preferences (GSP) cuts or removes tariffs on many goods from developing countries to promote trade.

IEEPA (International Emergency Economic Powers Act) a 1977 U.S. law that lets the President, after declaring a national emergency tied to a foreign threat, block property and restrict transactions to protect national security, foreign policy, or the economy.

Significance

Requires the President to declare a national emergency about a foreign threat.

Allows assets to be frozen and block or allow specific transactions (through OFAC).

Common used for sanctions to limit trade and finance with certain countries, people, or sectors.

Executive branch must report to Congress, and courts can review.

Violations can bring heavy fines or jail

Modern Trump tariffs: The Executive branch imposes broad tariffs using delegated authority and emergency powers to negotiate reciprocal deals. The deals create leverage for US interests, and represent a shift from multilateral deals to US first agreements.

Significance

- Broad Tariffs as a negotiating tool in the strong Executive model of negotiation

Goal to reset trade expectations with partners where free trade is reciprocal

Used in geopolitical great power check to limit economic and military threat of potentially hostile peers

- Leveraging Emergency Powers (IEEPA) to act on non trade and economic interests like Border Security, and Fentanyl enforcement.