A Former NY Federal Reserve Chair in 1946 posited that question. His responses are fascinating.

Government Taxes

A Former NY Federal Reserve Chair in 1946 posited that question. His responses are fascinating.

A review of DOGE’s legacy, Elon Musk’s impact and accomplishments.

How the Ultra Wealthy legally navigate the Tax Code in ways you can’t

America’s Financial Report Card – how did we do?

When the budget is on Auto Pilot, there is little flexibility for Congress.

Universal High Income: Utopian Future or Unobtainable Fantasy? Explainer on UHI.

How to Donate to our Government: The Options Explained. A Quick Reference to how to help your country.

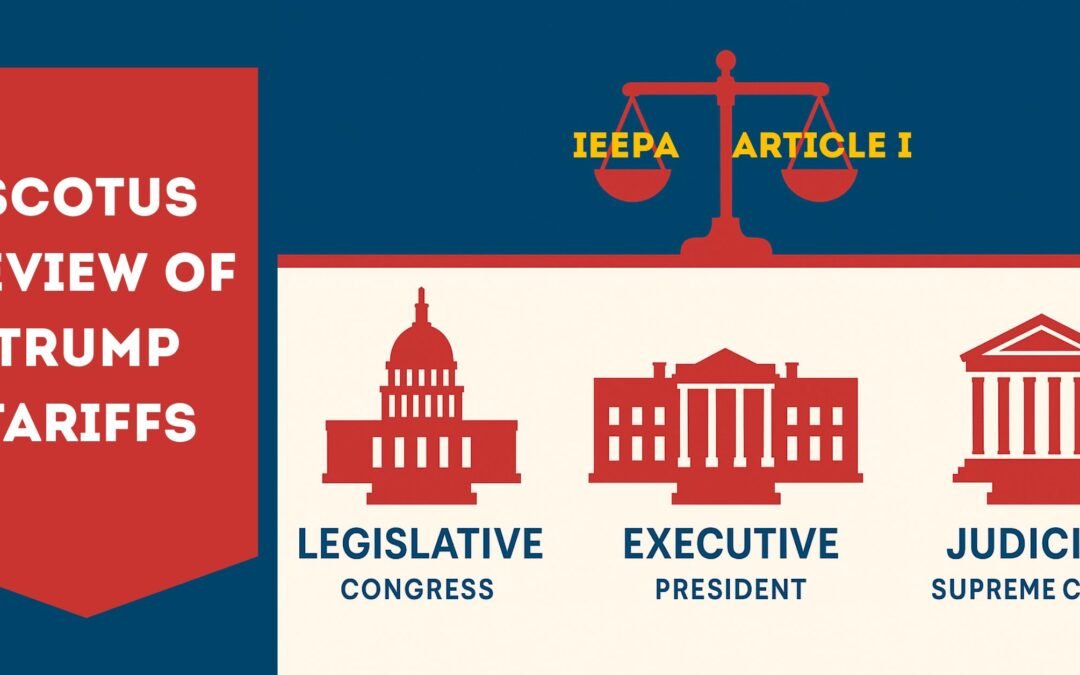

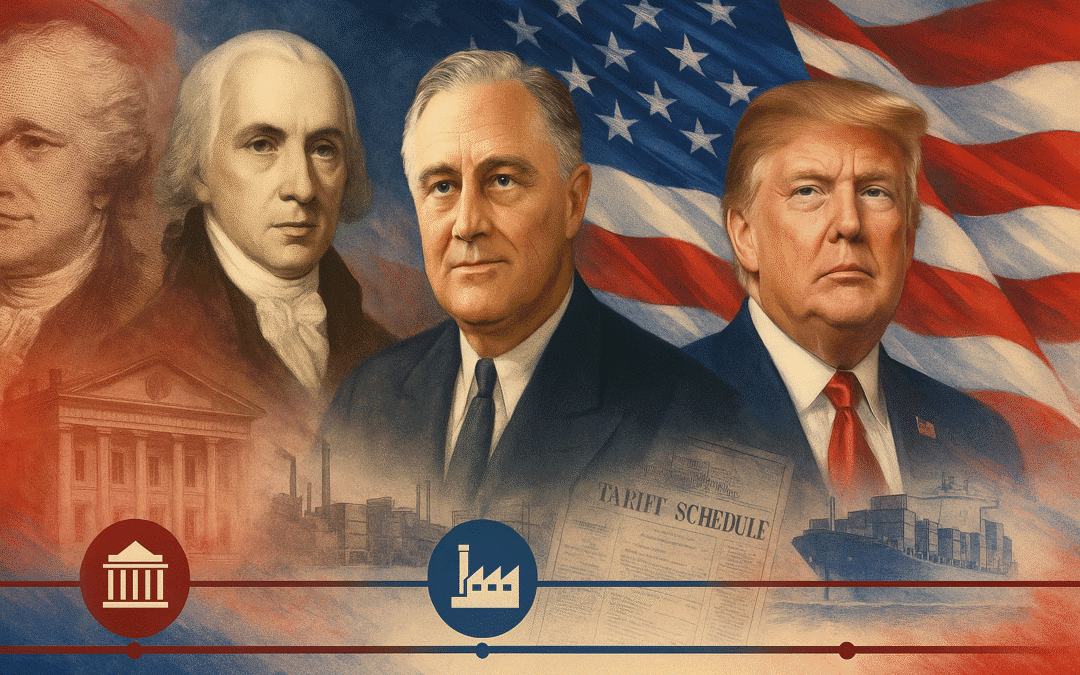

SCOTUS Ruling – The shifting roles of Tariffs from revenue to geopolitical power projection, and the historical roles of Congress and the President.

The History of US Government Tariffs from Madison and Hamilton to Trump. The shifting responsibilities and functions of tariffs.