US Backed Youth Investment Program

A new Government program called Invest America aimed at creating investment accounts for youth called Invest America accounts, commonly referred to as a “Trump Accounts” was created as part of the One Big Beautiful Bill, Section 530a, is available for signup next year and it is something every parent should know about and consider. It is designed to give children a long-term savings and investing vehicle and even FREE starter money (see details below). This article is an explainer to help you understand what the program is, what it’s good for, eligibility requirements, and how to signup for the program.

High Level Summary

At a high level the Invest America Program is a Government sponsored Investment program for Youth.

- Who it’s for: all children under 18 (activated by a parent/guardian). [2]

- Investments: Contributions must be invested in index funds that track the stock market (i.e., broad investments, not stock-picking). [4][5]

- Access to Funds: Generally accessible at age 18 for qualified expenses. [4][5]

- Contributions: Up to $5,000 per year. [1]

Why is the Invest America Program a good thing?

Investing wisely is always a good idea, but investing wisely early in life is an even better idea because of the power of compounding. The Invest America account is a great way to help your child by teaching them the power of investing, while giving them a powerful tool to assist with their Financial well being. This program could be the gateway to help families of all background to home ownership, college educations, and more vibrant economic futures. Here are some great features of the program:

Savings – The program is similar to a IRA for youth or a 529 savings plan, you can invest and earnings compound over time and they have access to it when they turn 18 years old on qualified expenses (e.g. College, Work Credentials, starting a business, First Time Home purchase). [1][2] Unlike a 529 they can use it on qualified expenses other than education.

Guard Rails – The program by law only allows investments in broad US Index Funds, like the S&P 500, with low fees (No more than 0.10%). These investments beat most other investment classes over the long term. These index funds are diversified, professionally managed, overseen by the Treasury and help novice investors by investing in the broad market and helping them share in the gains in America.

Contributors & Contributions – The program allows up to $5000 a year per child in contributions that can come from almost anyone including Parents, Guardians, Friends & Family, and that limit maybe increased by Qualified Charitable Organization and Government Entity contributions that allow contributions above the $5000 annual limit.

Tax Deferred – The investment earnings are held tax free until withdrawal. At 18 the money maybe withdrawn for qualified expenses and those withdrawals become taxable. After 18 the account acts like a normal IRA with (not IRA ROTH) with the same rules and limits.

Free Starter Money – Your child maybe eligible for FREE Starter money, up to $1000, see details below. A head start from birth means more time to compound and grow investments.

Charitable Contributions – There is a growing list of philanthropist that are donating significant amounts to this program, and the ability of additional non profits to contribute to accounts for various constituents, especially for those most in need. See details below.

Employer Benefits – Dozens of companies are jumping on the bandwagon and specifically supporting the Invest America program and providing Employer Benefits for child Invest America accounts. Creating a whole new category of Employee Benefit beyond Child Care subsidies. A large and growing list of major companies are supporting this initiative.

What is it good for?

Helping your child understand Finances can be one of the most powerful and important things a parent can do for their child. Setting them up, and helping them understand Finances and ensuring their Financial Wellbeing can set them up for a lifetime of success. The program can help with:

Financial Literacy – Teaches your child about investing, and exposes them to understand concepts like savings, compounding, and the stock market.

Wealth Building – It invests in equity index funds exposing them to one of the best investment and wealth building classes of investments over the long term, helping them gain access to one of the best assets used by the Wealthy to accumulate wealth.

Major Life Purchases – The program can be used to help youth invest in their first house, pay for college, work credential programs, or starting their own business. All major life events that can improve a persons outlook on the future.

Retirement Security – By investing early, and using the account as a retirement account. After 18 you can continue to invest with the same rules as an IRA over a very long horizon and really take advantage of the power of compounding to create a large financial asset for your child when they retire.

How to Signup?

Full signup details are not available yet but sign-ups are expected to open July 4, 2026, and the government has said official enrollment instructions and approved providers will be published when enrollment opens. [2][3] These signups will be separate from your Tax Returns, and you must sign up to be eligible. We will update this article when the announcement is made, and details are available with a link and instructions.

Eligibility for the $1,000 FREE Federal Starter Money

One of the great components of this program is a head start for Newborns. The program will seed $1000 into the account for those eligible, giving an incredible head start in investing, and potentially turning into 65 years or more of investing and compounding before retirement something that is often only common in the very wealthy or fiscally disciplined. Here’s the details for the Federal Starter deposit:

- Must be born after December 31, 2024, and before January 1, 2029 (i.e. Calendar years 2025-2028), if an account is established for them. [1]

- Must be an American citizen

- Must have a valid Birth Certificate

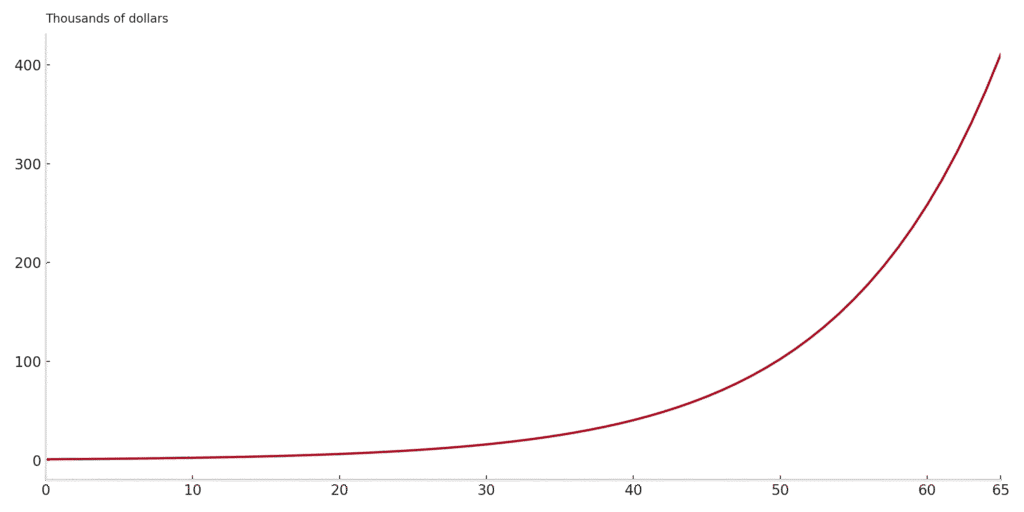

“If you could give your child $1 Million for retirement, would you?”

This is not a joke! No, the Government is NOT going to give you $1 Million dollars, but with a little effort they can give you a decent chance to make $1 Million, and all you need is time, patience, and a small investment and compounding will do the heavy lifting. The program is built to be a platform to encourage continued saving (parents, family, and potentially employers/partners), not just a one-time seed. [1][2] Even modest contributions early can push the retirement age value toward (or beyond) seven figures. Here is the scenario, you have a Newborn, you enroll them in the Invest America program and they receive their $1000 Federal Starter money and keep it for 65 years invested in an S&P 500 Index Fund.

What you could get for FREE*

If the account receives the Starter Seed $1,000 at birth and stays invested until age 65 with NO other investments you can get:

| Initial Investment | $1000 |

| Rate of Return | 9.7% Annual (9.8% S&P 500 historical baseline minus 0.10% fees) [8] |

| Time Period | 65 Years |

| Value at End of Period | $410,611.20 (Not bad for NO cost) |

Other Scenarios (All seven figures)

We’ve run a few other scenarios, one with a modest $12 a month contribution, another with a $500 a year contribution, and a max contribution scenario. One requires skipping a few coffees a month, the other is probably a heavier lift for most people but still doable, and the last is probably out of reach for many, but here for illustration purposes.

| Scenario 2 (Low) | Scenario 3 (Modest) | Scenario 4 (Max) | |

|---|---|---|---|

| Initial Investment | $1,000 | $1,000 | $1000 |

| Rate of Return | 9.7% | 9.7% | 9.7% |

| Ongoing Contribution | $12/month ($144/year) | $500/year | $5000/year Max |

| Time Period | 65 Years | 65 Years | 65 Years |

| Contribution at End | $9,360 | $32,500 | $325,000 |

| Value at End of Period | $1,050,191.65 | $2,726,814.75 | $23,572,646.64 |

Run your own Scenarios with the Tax Project Investment Calculator

Note*, these estimates are hypothetical and based on historical averages and assume you were eligible for the $1000 Starter seed deposit. Your actual returns may vary based on the market and these estimates do not calculate inflation or include the taxable gains costs which maybe substantial. Use the calculator to provide estimates and speak with a Financial Advisor for your specific needs to review the numbers.

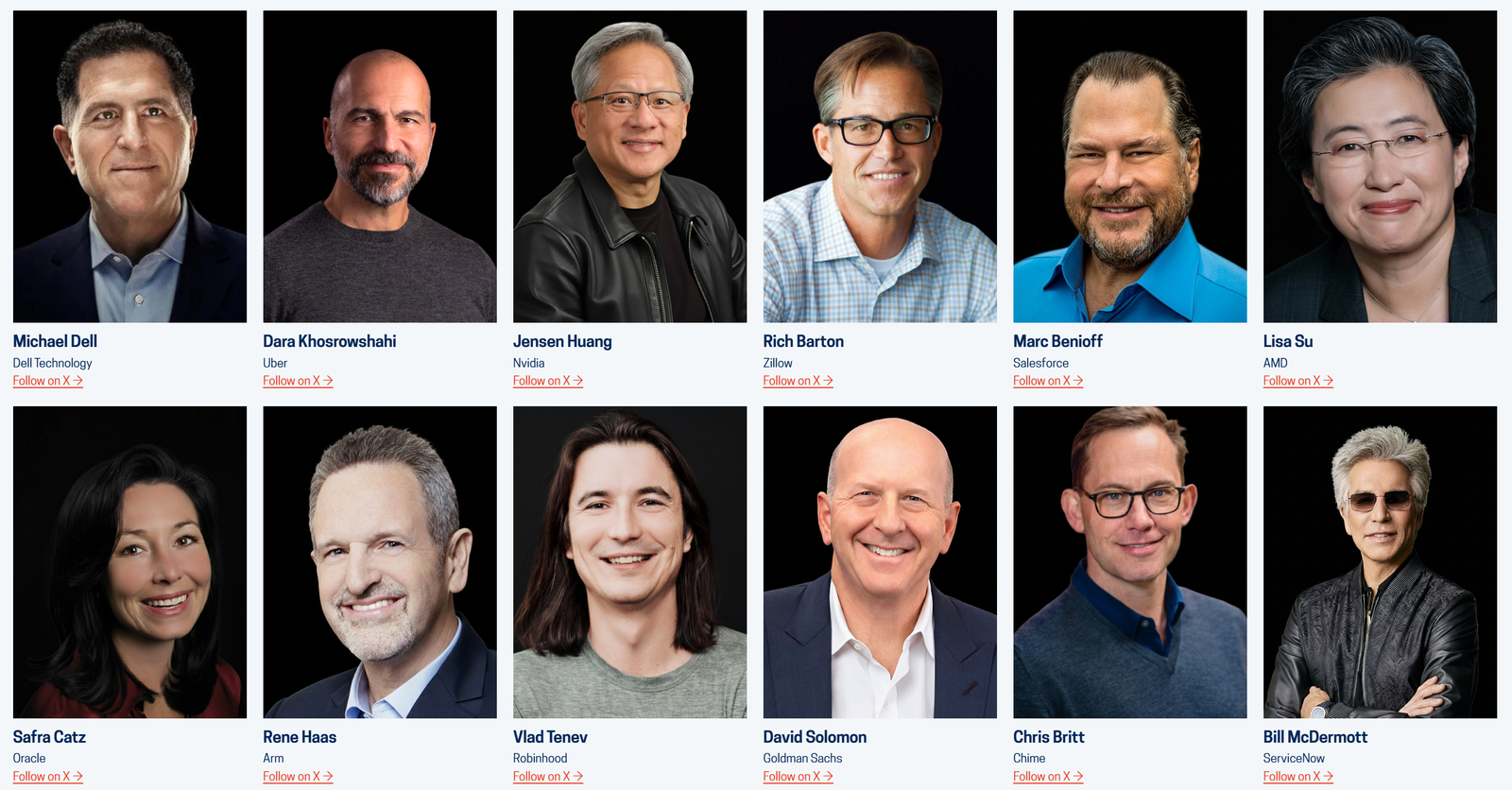

Charitable and Employer Contributions

The Invest America program has specific carveouts for non family contributions including Non Profit organizations and Government Entities that are making significant pledges and contributions specifically to the program. Just this month Michael and Susan Dell announced a $6.25 Billion contribution to expand eligibility beyond newborns. The funding is for $250 for up to 25 million children, aimed at kids who do not qualify for the federal $1,000 newborn seed. [4][5][9] Non Profit 501(c)3 organizations like InvestAmerica.org are being setup specifically to promote and support Invest America and provide resource and a place where Philanthropists, and Parents can learn more and lend support.

These companies and more are contributing, including some providing employee benefits for child Invest America accounts.

Summary

At the Tax Project we do not promote specific policies, but it’s hard not to like something with so many positive benefits. While nothing is perfect, and as with all programs there will likely be some hiccups, challenges, and critics – it is nice to see a program that targets helping the youth of America in a broad way that helps everyone but also provides a boat that will lift many disadvantaged children and potentially dramatically change their future trajectory for the better and help them share in American prosperity. Honestly, with all the gloom and doom around the National Debt, Social Securities challenges, Student Debt, Home affordability, Cost of Living challenges that the youth today face, having a public program with deep cooperation from the private sector allowing our youth access to the Capital markets, and giving them support and more importantly hope that their future may be better. Every parent, every child, and every business leader should know about this program. Check in periodically, we will be following and providing more on this program and looking for ways to contribute our support.

References

[1] The White House. (2025, August 29). Trump Accounts Give the Next Generation a Jump Start on Saving. (The White House)

[2] Invest America. (n.d.). Invest America – program overview (sign-ups expected July 4, 2026; eligible children under 18). (Invest America)

[3] Invest America. (n.d.). FAQ – Treasury/IRS instructions and approved providers at enrollment. (Invest America)

[4] Reuters. (2025, December 2). Michael and Susan Dell pledge $6.25 billion… (Reuters)

[5] Associated Press. (2025, December 2). Michael and Susan Dell donate $6.25 billion… (AP News)

[6] Shiller, R. (n.d.). Online Data – U.S. Stock Markets 1871-Present. Yale University. (econ.yale.edu)

[7] Siegel, J. J. (1992). The Equity Premium: Stock and Bond Returns since 1802. (efinance.org.cn)

[8] Damodaran, A. (n.d.). Historical Returns on Stocks, Bonds and Bills (S&P 500), 1928-2024. NYU Stern. (Stern School of Business)

[9] The White House. (2025, December 2). Landmark Dell Gift Supercharges Trump Accounts for America’s Kids. (The White House)